On Friday, GBP rose 0.49% against the USD and closed at 1.5449, after UK Prime Minister, David Cameron regained power as Conservative party registered victory in Britain’s general elections.

In economic news, the UK trade deficit narrowed to £2.8 billion in March from £3.3 billion in February. Meanwhile, the Halifax house price index rose 1.60% MoM in April, compared to a revised rise of 0.60% in the prior month. Markets were anticipating the index to climb 0.30%.

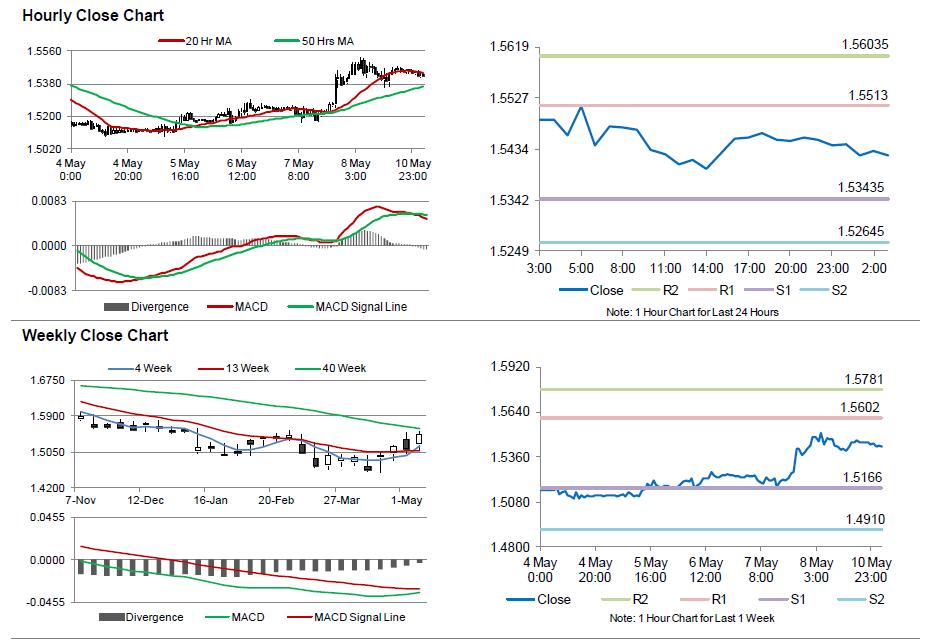

In the Asian session, at GMT0300, the pair is trading at 1.5423, with the GBP trading 0.17% lower from Friday’s close.

The pair is expected to find support at 1.5344, and a fall through could take it to the next support level of 1.5265. The pair is expected to find its first resistance at 1.5513, and a rise through could take it to the next resistance level of 1.5604.

Trading trends in the Pound today are expected to be determined by the BoE’s crucial interest rate decision.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.