For the 24 hours to 23:00 GMT, the GBP rose 0.68% against the USD and closed at 1.4345.

Yesterday, the BoE Governor, Mark Carney, indicated that the decision of the US Fed to tighten its monetary in December has partly contributed to the market volatility in emerging economies. He also added that the risks to the global financial markets is shifting from advanced economies to growing economies.

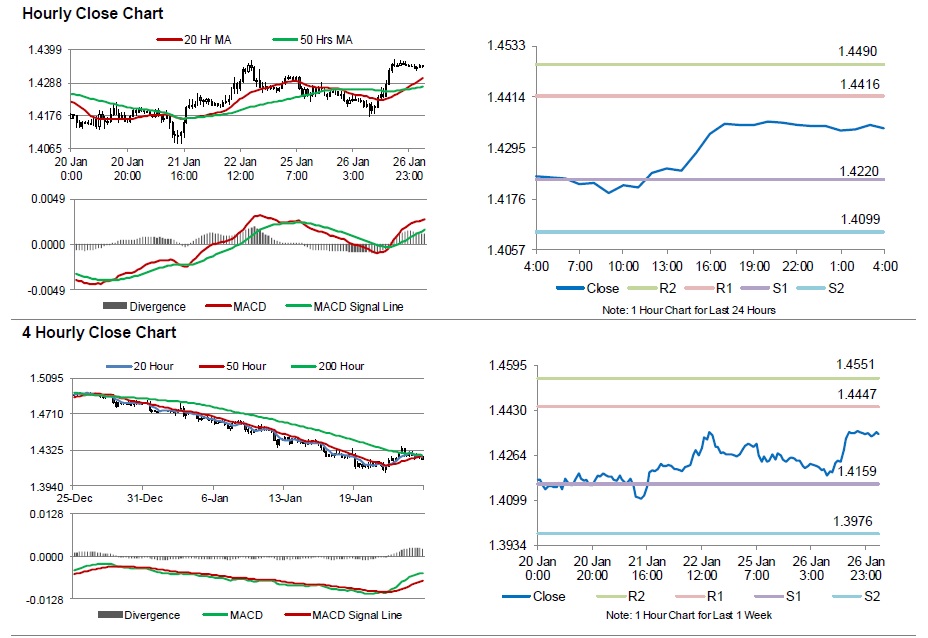

In the Asian session, at GMT0400, the pair is trading at 1.4342, with the GBP trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.4220, and a fall through could take it to the next support level of 1.4099. The pair is expected to find its first resistance at 1.4416, and a rise through could take it to the next resistance level of 1.4490.

Moving ahead, investors await the release of UK’s seasonally adjusted nationwide house prices data for January, as well as mortgage approvals data scheduled to be released in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.