For the 24 hours to 23:00 GMT, the GBP fell 0.55% against the USD and closed at 1.4367, after UK’s seasonally adjusted construction output declined more-than-expected by 3.6% MoM in March, its third consecutive drop, as heightened uncertainty over the European Union referendum weighed on the nation’s construction sector activity. Investors had expected a 3.2% decline, following a 0.9% fall in the previous month.

Separately, the International Monetary Fund’s (IMF) Managing Director, Christine Lagarde, echoed similar comments from the Bank of England (BoE) Governor, Mark Carney, warning that exiting the European Union would be “pretty bad to very, very bad” for the British economy and could push the country into recession.

In the Asian session, at GMT0300, the pair is trading at 1.4365, with the GBP trading marginally lower from Friday’s close.

Overnight data showed that, UK’s Rightmove house price index advanced 0.4% in May, following a 1.3% gain in the prior month.

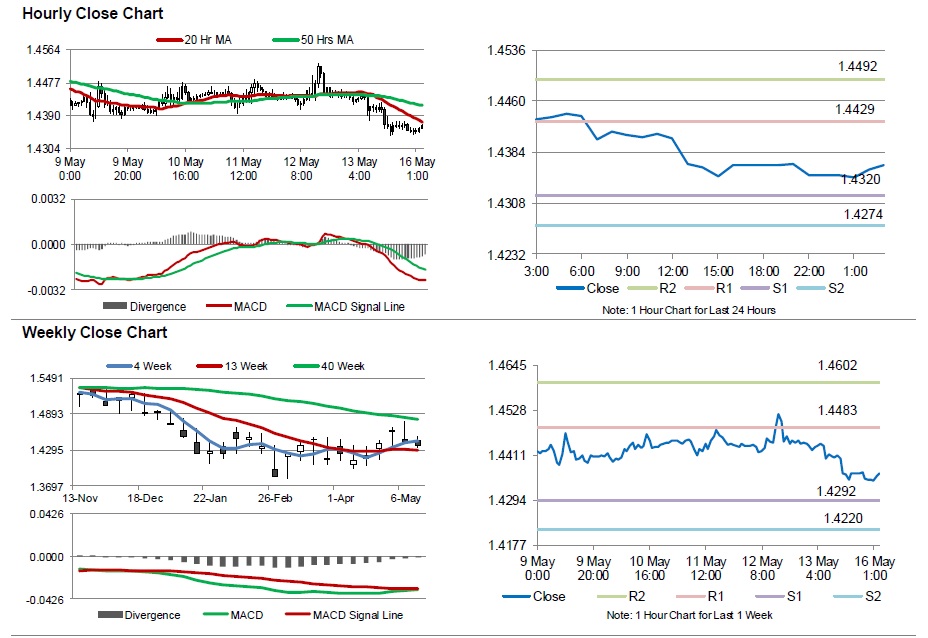

The pair is expected to find support at 1.4320, and a fall through could take it to the next support level of 1.4274. The pair is expected to find its first resistance at 1.4429, and a rise through could take it to the next resistance level of 1.4492.

Going ahead, investors will look forward to UK’s consumer price index data for April, scheduled to release tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.