On Friday, GBP declined 0.09% against the USD and closed at 1.5400, following worse than expected retail sales data in the UK.

Britain’s retail sales slid 0.30% on a monthly basis in January, more than market expectations for a drop of 0.20%, thus dampening investor optimism in the nation.

In other economic news, the public sector net borrowing in the UK registered a deficit of £9.40 billion in January, as compared to a revised surplus of £9.90 billion in the prior month. Market expectations were expecting the nation to register a deficit of £9.30 billion.

In the Asian session, at GMT0400, the pair is trading at 1.5380, with the GBP trading 0.13% lower from Friday’s close.

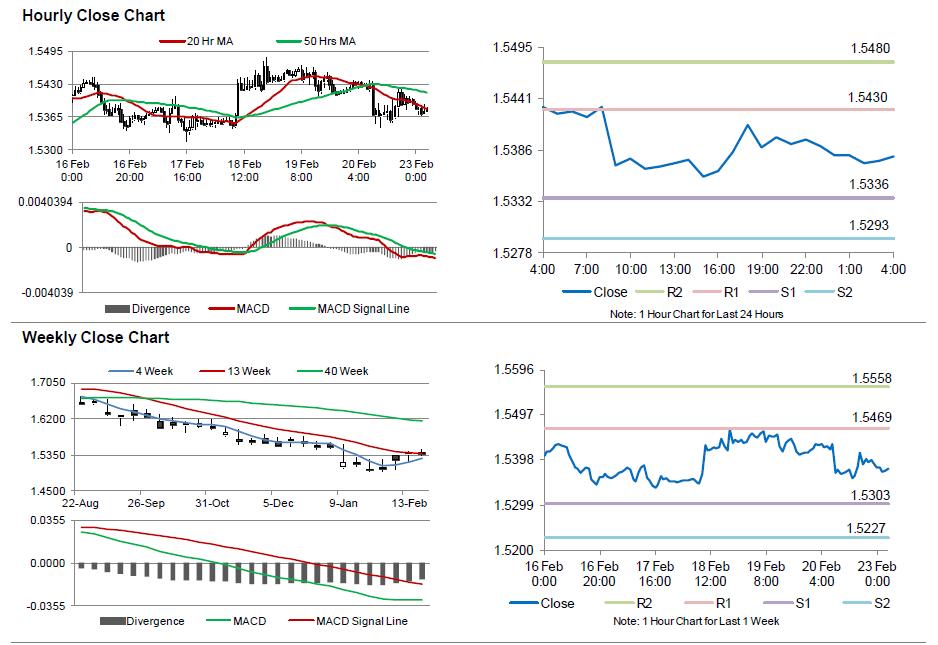

The pair is expected to find support at 1.5336, and a fall through could take it to the next support level of 1.5293. The pair is expected to find its first resistance at 1.543, and a rise through could take it to the next resistance level of 1.5480.

Trading trends in the Pound today would be determined by CBI Distributive Trade survey data, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.