For the 24 hours to 23:00 GMT, the GBP rose 0.13% against the USD and closed at 1.5676, after NIESR reported that Britain’s GDP rose 0.7% in the three months ended November, compared to a similar growth registered in the earlier period.

However, gains in the GBP were kept in check after manufacturing production in the UK unexpectedly eased 0.7% on a monthly basis in October, dropping for the first time in 5 months and compared to a rise of 0.6% recorded in the previous month. Markets were expecting it to post an increase of 0.2%. Additionally, the nation’s industrial production surprisingly recorded a fall of 0.1% on a monthly basis in October, following an advance of 0.6% registered in the previous month.

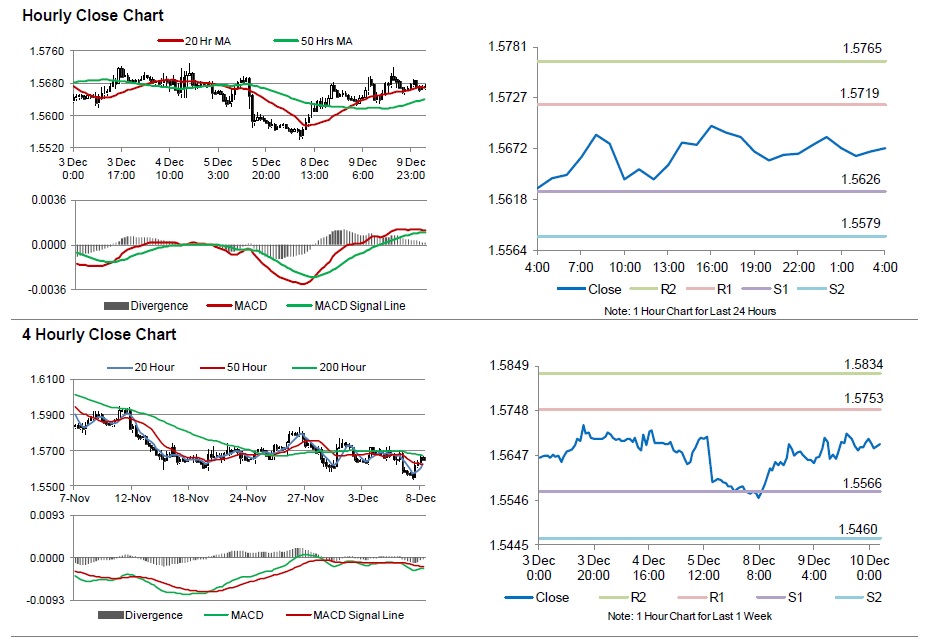

In the Asian session, at GMT0400, the pair is trading at 1.5672, with the GBP trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.5626, and a fall through could take it to the next support level of 1.5579. The pair is expected to find its first resistance at 1.5719, and a rise through could take it to the next resistance level of 1.5765.

Trading trends in the Pound today are expected to be determined by the UK’s total trade balance data, scheduled in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.