For the 24 hours to 23:00 GMT, the GBP traded flat against the USD and closed at 1.3843.

Yesterday, the Bank of England’s (BoE) policymaker, Gertjan Vlieghe, suggested that a further hike in interest rates was probably needed if the global economic recovery and a pick-up in wages continued to offset headwinds from Brexit.

In the Asian session, at GMT0400, the pair is trading at 1.3846, with the GBP trading marginally higher against the USD from yesterday’s close.

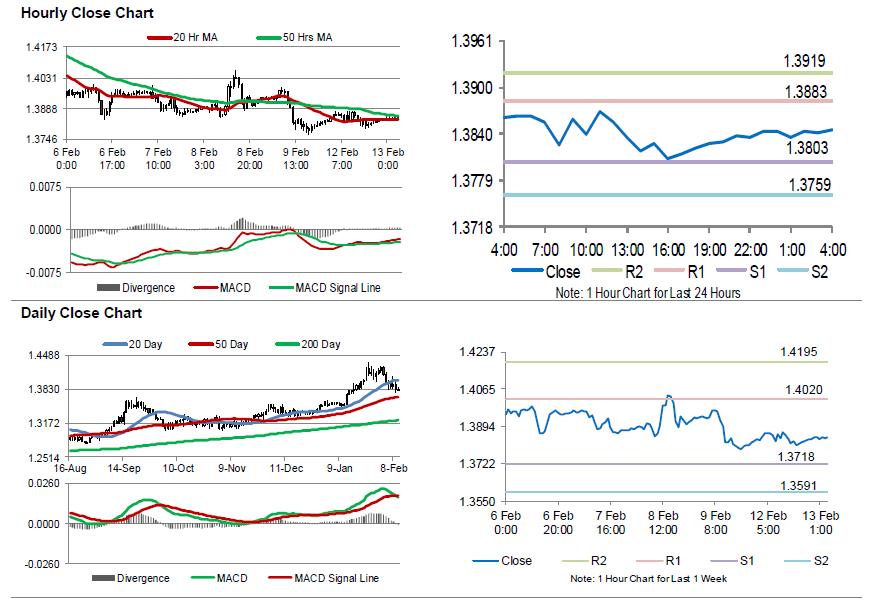

The pair is expected to find support at 1.3803, and a fall through could take it to the next support level of 1.3759. The pair is expected to find its first resistance at 1.3883, and a rise through could take it to the next resistance level of 1.3919.

Trading trend in the Pound today is expected to be determined by UK’s consumer price inflation and producer price index data for January, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.