For the 24 hours to 23:00 GMT, the GBP fell 0.21% against the USD and closed at 1.5319, after the UK posted a worse-than-expected goods trade deficit in August along with the nation’s construction output plunging at its fastest pace since 2012, in the same month.

Data showed that UK’s goods trade deficit stood at £11.1 billion in August, against an investor’s expectation of £10.0 billion and compared to an upwardly revised £12.2 billion in July. Meanwhile the country’s total trade deficit narrowed down to £3.3 billion in August, from £4.4 billion in the previous month. Further, the UK construction output unexpectedly contracted 4.3% MoM in August, compared to a 1.0% fall in July. Investors had expected it to rise 1.0%.

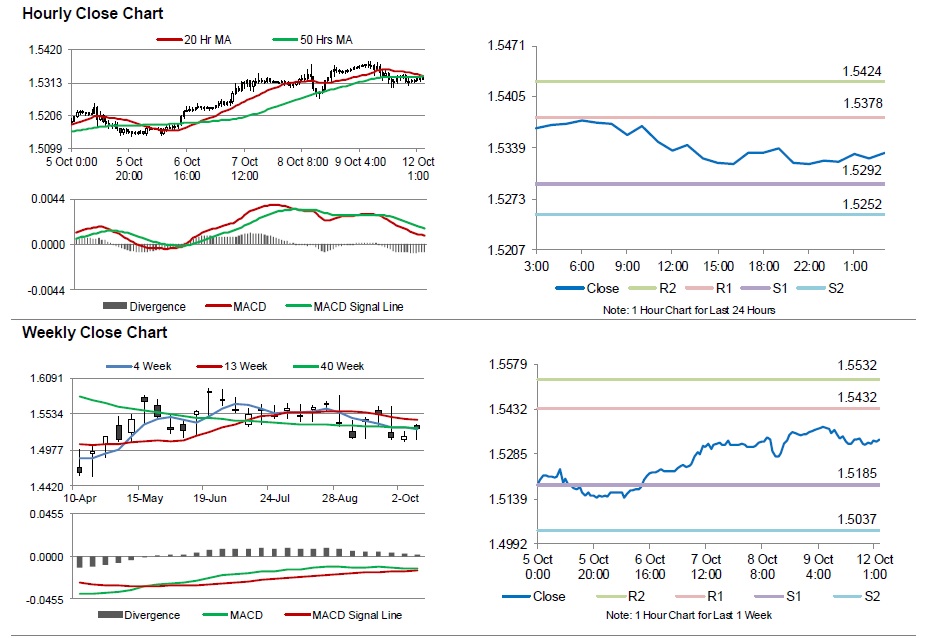

In the Asian session, at GMT0300, the pair is trading at 1.5332, with the GBP trading marginally higher from Friday’s close.

The pair is expected to find support at 1.5292, and a fall through could take it to the next support level of 1.5252. The pair is expected to find its first resistance at 1.5378, and a rise through could take it to the next resistance level of 1.5424.

Moving ahead, investors will look forward to the UK BRC retail sales monitor data for September, schedule to be release overnight.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.