For the 24 hours to 23:00 GMT, the GBP rose 0.23% against the USD and closed at 1.5352, after the BoE’s monetary policy committee decided to keep its benchmark interest rates steady at 0.5% and opted to keep its asset purchase facility program unchanged at £375 billion.

The minutes from the latest monetary policy meeting indicated the BoE’s UK growth forecast to slow to 0.6% in the third quarter, down from 0.7% in the previous three months.

Separately, the BoE Governor, Mark Carney, in a seminar at the annual meeting of the IMF stated that the central bank’s decision to raise interest rates is not necessarily dependant on the Fed’s interest rate decision. He further added that, Britain’s economy needed to make more progress in order to witness an interest rate hike, as a rate rise in early 2016 was still on cards.

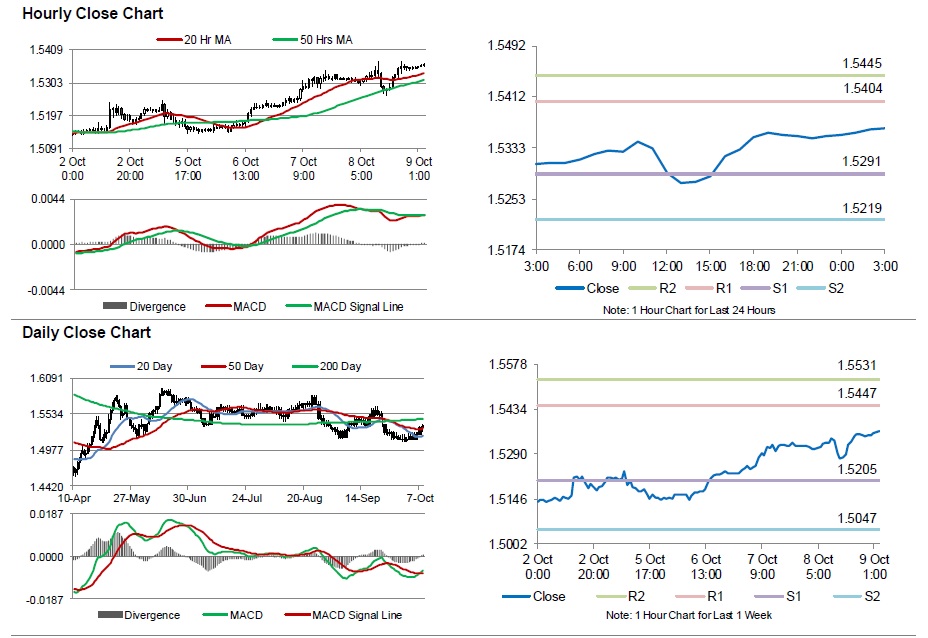

In the Asian session, at GMT0300, the pair is trading at 1.5363, with the GBP trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.5291, and a fall through could take it to the next support level of 1.5219. The pair is expected to find its first resistance at 1.5404, and a rise through could take it to the next resistance level of 1.5445.

Going ahead, investors will concentrate on Britain’s total trade balance data for August, scheduled in a few hours, for further cues.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.