For the 24 hours to 23:00 GMT, the GBP fell marginally against the USD and closed at 1.4250.

Yesterday, the BoE’s monetary policy committee member, Gertjan Vlieghe, struck a dovish tone by stating that UK’s current economic conditions do not warrant an interest rate hike and that he would take a “patient” approach to raising interest rates in future. He further cautioned that there was a chance he might even favour a rate cut if the slowdown in Britain’s economy worsened.

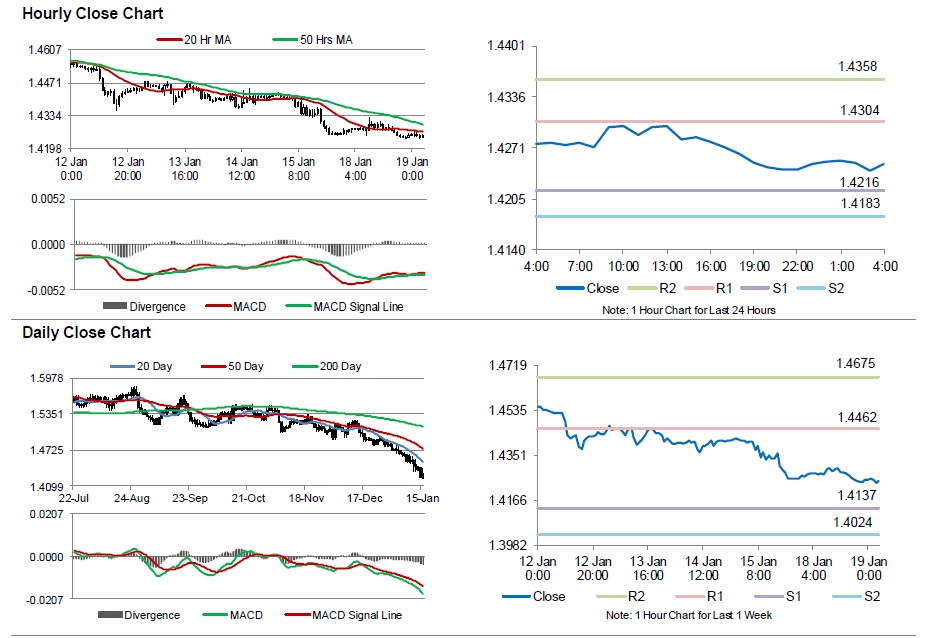

In the Asian session, at GMT0400, the pair is trading at 1.4249, with the GBP trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.4216, and a fall through could take it to the next support level of 1.4183. The pair is expected to find its first resistance at 1.4304, and a rise through could take it to the next resistance level of 1.4358.

Going ahead, investors will look forward to UK’s consumer price inflation data for December, scheduled to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.