For the 24 hours to 23:00 GMT, GBP rose 0.12% against the USD and closed at 1.5815, after the Bank of England’s decided to lift its bond-purchase program by £50 billion to £325 billion, and left interest rates unchanged at 0.5%

The GBP also received a boost after manufacturing production in the UK rose more-than-expected in December, increasing for the first time in three months, while industrial production also rose more-than-expected.

The GBP later on softened after the NIESR GDP estimate showed a contraction of -0.2% in January.

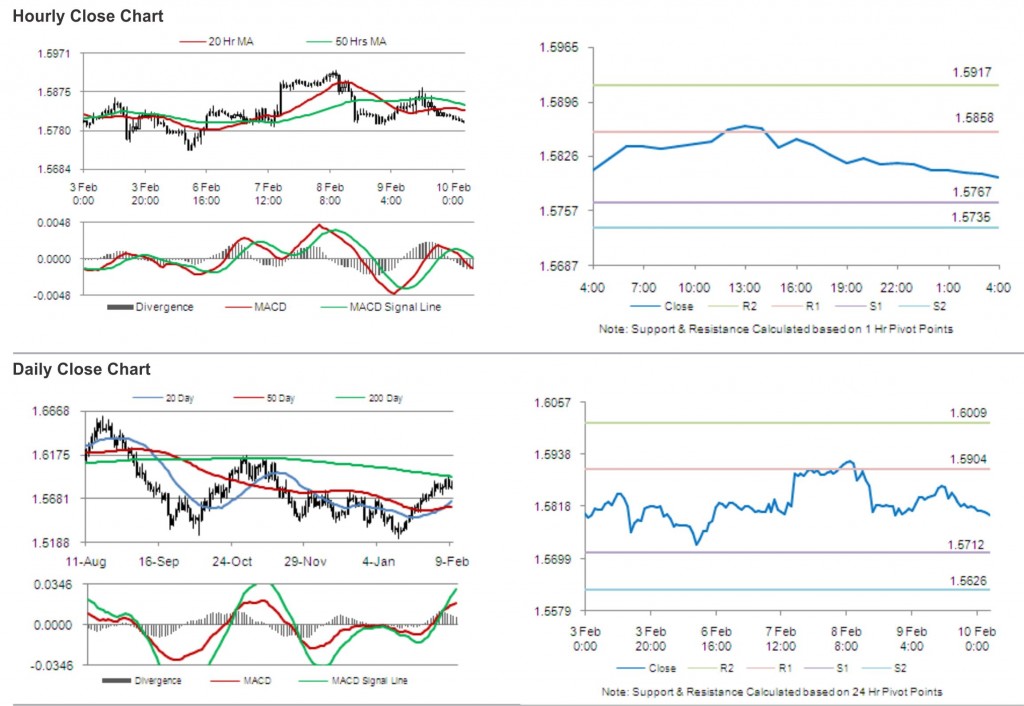

In the Asian session, at GMT0400, the pair is trading at 1.5798, with the GBP trading 0.11% lower from yesterday’s close.

The pair is expected to find support at 1.5767, and a fall through could take it to the next support level of 1.5735. The pair is expected to find its first resistance at 1.5858, and a rise through could take it to the next resistance level of 1.5917.

GBP is likely to receive increased market attention, with Producer Price Index data due to be released later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.