For the 24 hours to 23:00 GMT, GBP fell 0.10% against the USD and closed at 1.6621, after the Bank of England (BoE) Governor, Mark Carney dampened expectations for rate hike in the near future, to prevent the economy from overheating. He further hinted that the central bank would gradually raise its main interest rate from the current record low level over the next three years and added that the recovery in the nation would continue, without inflation moving higher. However, another BoE policymaker, Martin Weale, dissented with the Governor’s view and stated that “the best estimate of the amount of spare capacity in the economy is something under 1%.”

On the economic front, industrial production in the UK rose less than market estimates 0.1% (MoM) in January while manufacturing production outpaced expectations and rose 0.4% (MoM) in January. Separately, the NEISR, in its monthly estimate report, revealed that UK GDP rose 0.8% in the three months to February, faster than a 0.7% rise reported in the three months ending January.

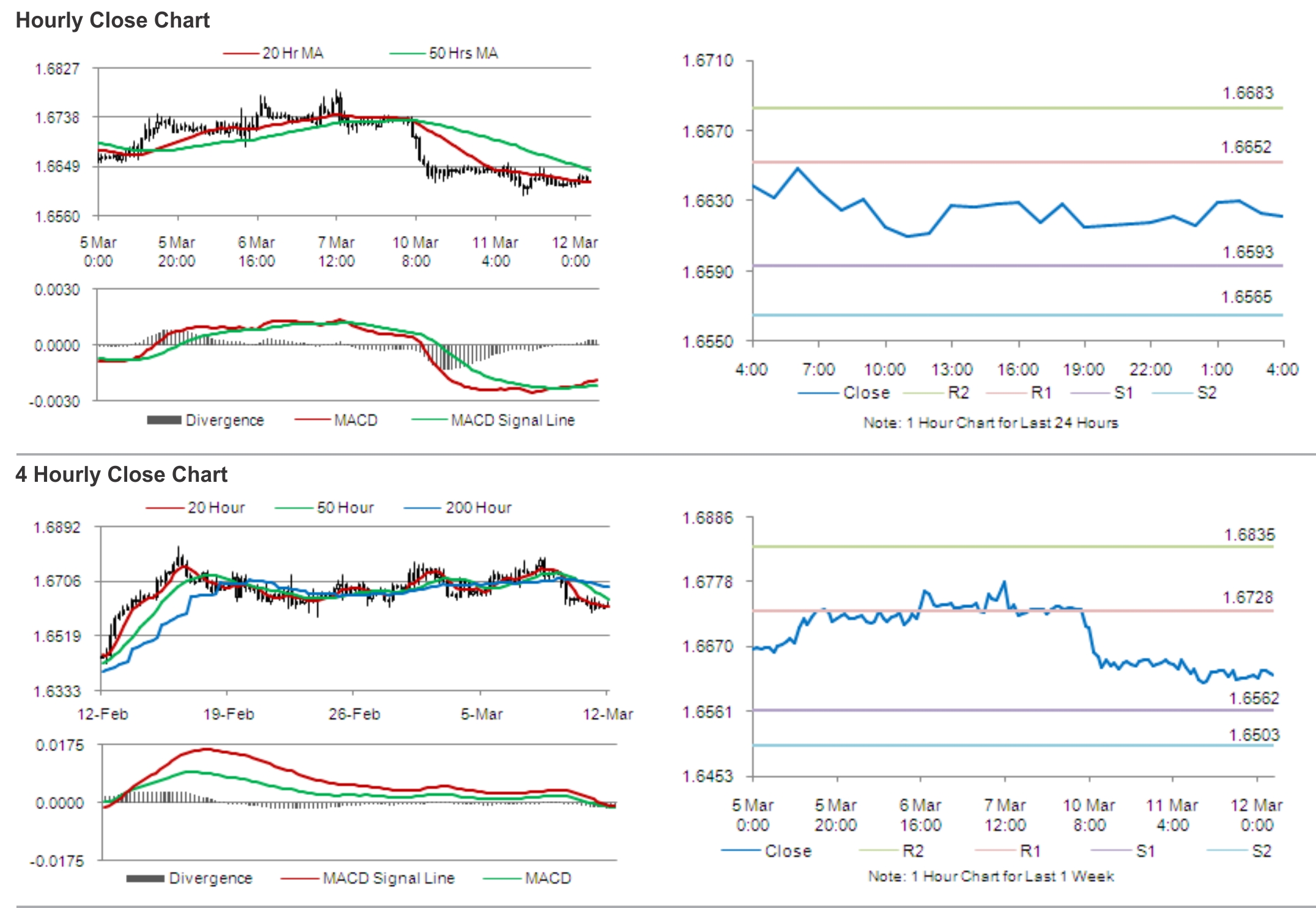

In the Asian session, at GMT0400, the pair is trading at 1.6621, with the GBP trading flat from yesterday’s close.

The pair is expected to find support at 1.6593, and a fall through could take it to the next support level of 1.6565. The pair is expected to find its first resistance at 1.6652, and a rise through could take it to the next resistance level of 1.6683.

Amid lack of economic releases from the UK, traders would keep a tab on global economic news for further guidance in the pair.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.