For the 24 hours to 23:00 GMT, the GBP fell 0.06% against the USD and closed at 1.5220.

Yesterday, the BoE Deputy Governor, Ben Broadbent, announced that the central bank would undertake an interest rate hike only during the second half of next year. He further stated that the country’s unit labour costs should increase before the central bank achieves its inflation target of 2%.

On the macroeconomic front, the British Bankers’ Association reported that the UK mortgage approvals rose to 46,743 in August from 46,315 in July, its highest level since early 2014. Market participants had forecasted 47,000 approvals for August.

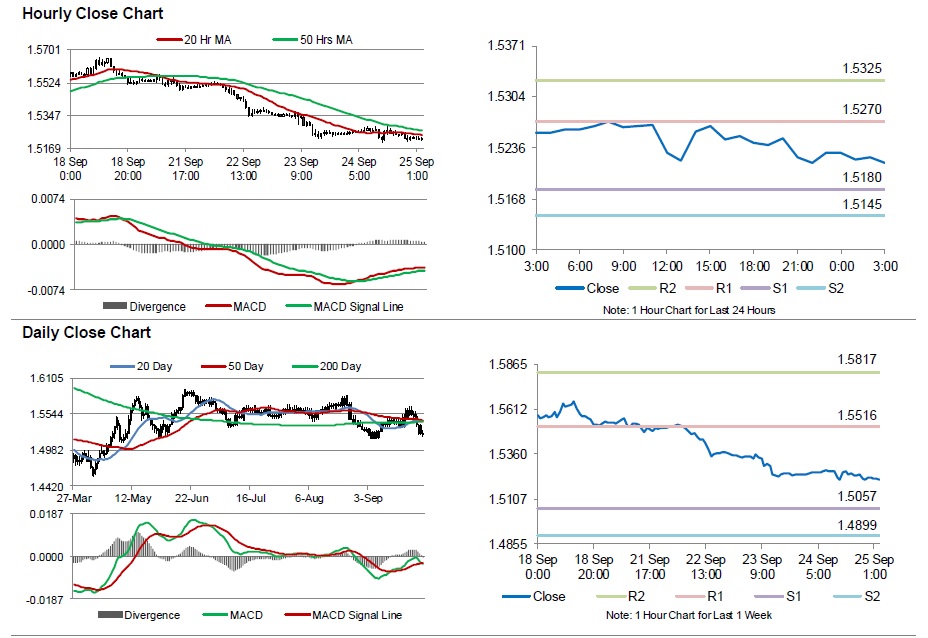

In the Asian session, at GMT0300, the pair is trading at 1.5215, with the GBP trading 0.09% lower from yesterday’s close.

The pair is expected to find support at 1.518, and a fall through could take it to the next support level of 1.5145. The pair is expected to find its first resistance at 1.527, and a rise through could take it to the next resistance level of 1.5325.

Going forward, investors would keep a close eye on UK’s crucial Q2 GDP as well as services, manufacturing and construction PMI data’s in the coming week to get better insights in the nation’s economy.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.