For the 24 hours to 23:00 GMT, the GBP rose 1.06% against the USD and closed at 1.3259, amid news of a potential Brexit delay.

Data showed that UK’s BBA mortgage approvals unexpectedly rose to a level of 40.6K in January, compared to a revised level of 39.4K in the prior month. Markets had anticipated the BBA mortgage approvals to ease to a level of 38.4K.

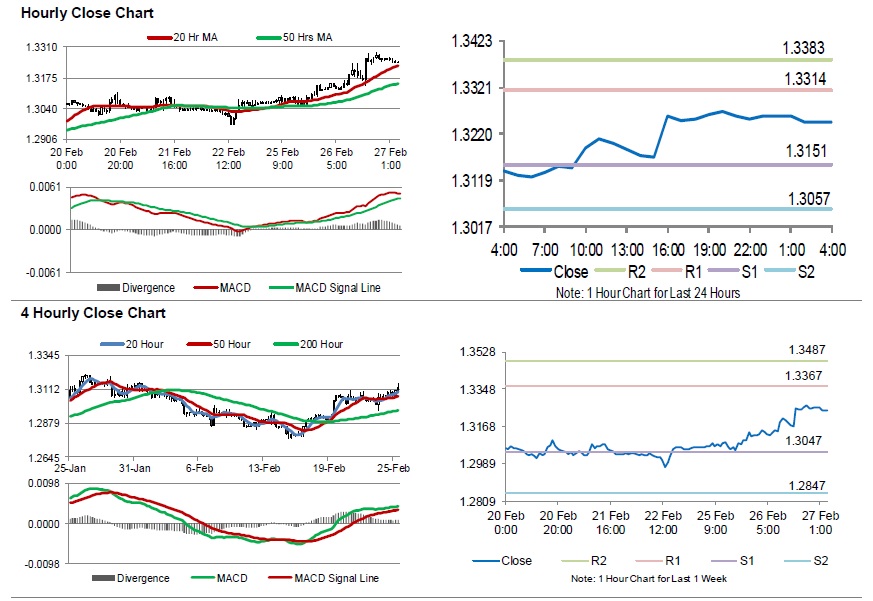

In the Asian session, at GMT0400, the pair is trading at 1.3246, with the GBP trading 0.10% lower against the USD from yesterday’s close.

Overnight data revealed that Britain’s BRC shop price inflation advanced to a six-year high level of 0.7% on an annual basis in February, beating market expectations for a rise of 0.3% and compared to a gain of 0.4% in the preceding month.

The pair is expected to find support at 1.3151, and a fall through could take it to the next support level of 1.3057. The pair is expected to find its first resistance at 1.3314, and a rise through could take it to the next resistance level of 1.3383.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.