For the 24 hours to 23:00 GMT, GBP fell 0.50% against the USD on Friday and closed at 1.5737.

Data released in the UK showed that the producer price inflation in the UK eased to 4.1% (YoY) in January, marking the lowest annual rate since November 2010 and compared to a rate of 4.8% recorded in the previous month. Meanwhile, the Core Output Price Index rose 2.4% in January, the lowest annual rate since February 2010.

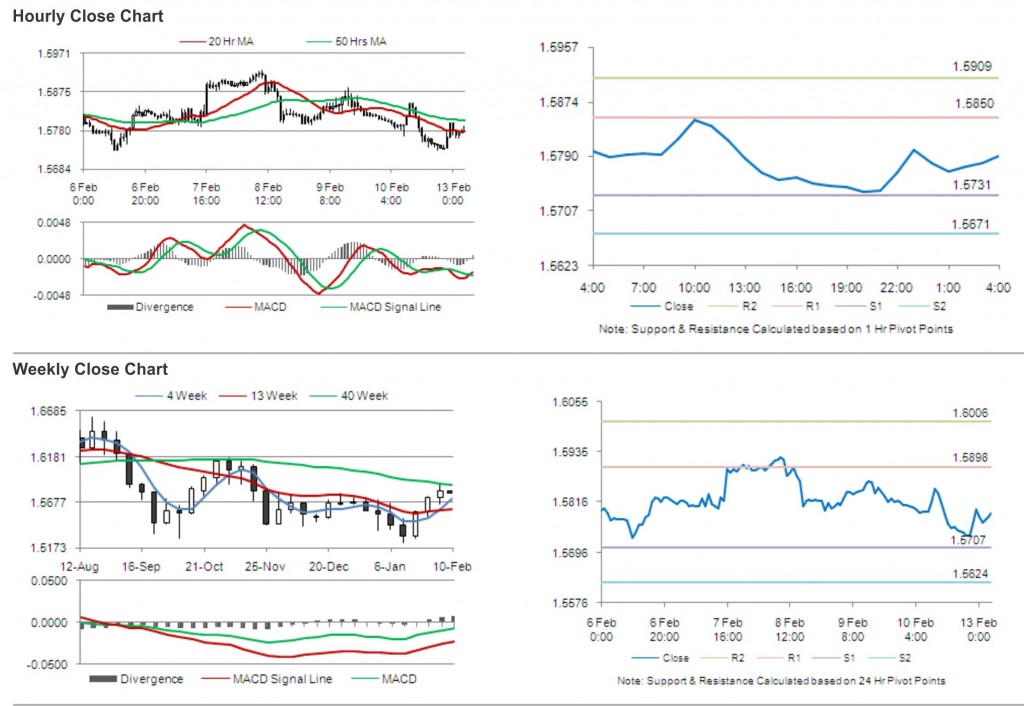

In the Asian session, at GMT0400, the pair is trading at 1.579, with the GBP trading 0.34% higher from Friday’s close.

The Confederation of British Industry (CBI) stated that the UK economy would avoid a technical recession and the recovery would gain momentum in 2012, avoiding the need for more quantitative easing by the Bank of England.

The pair is expected to find support at 1.5731, and a fall through could take it to the next support level of 1.5671. The pair is expected to find its first resistance at 1.5850, and a rise through could take it to the next resistance level of 1.5909.

The UK economic calendar being almost empty today, the pair is expected to ride on other market cues.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.