For the 24 hours to 23:00 GMT, the GBP rose 0.44% against the USD and closed at 1.3137, amid news emerged that the British Prime Minister, Theresa May, could reshuffle her cabinet and leave out Foreign Secretary, Boris Johnson.

Meanwhile, the UK Prime Minister, Theresa May, warned the British public to prepare for crashing out of the European Union (EU) with no deal, outlining contingency plans to avoid border meltdown for businesses and travellers. Further, May noted that UK would publish two white papers on trade and customs after Brexit.

In the Asian session, at GMT0300, the pair is trading at 1.3155, with the GBP trading 0.14% higher against the USD from yesterday’s close.

Overnight data indicated that UK’s BRC retail sales across all sectors recorded a rise of 1.9% on an annual basis in September, rising by the most this year and following a gain of 1.3% in the prior month.

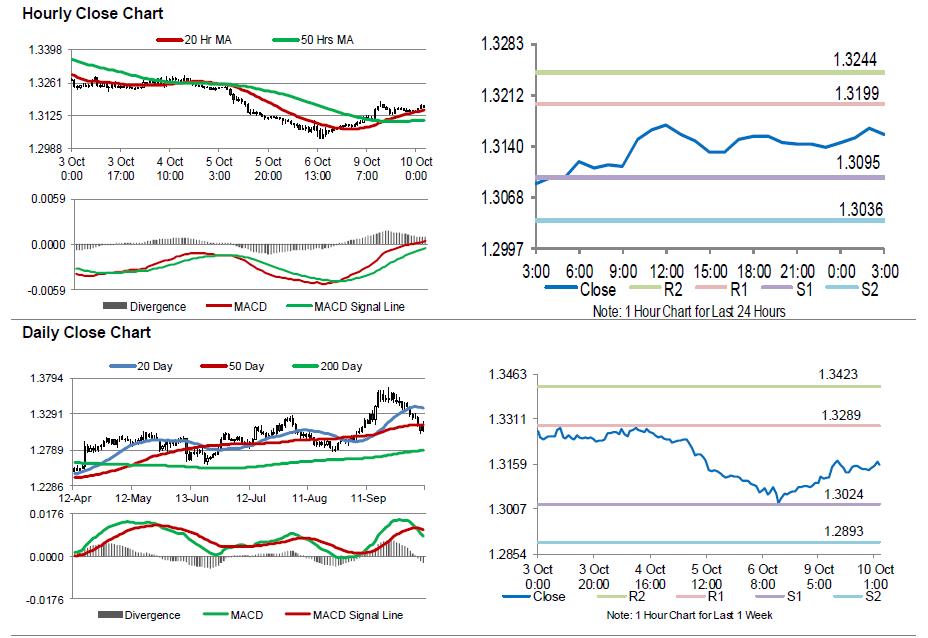

The pair is expected to find support at 1.3095, and a fall through could take it to the next support level of 1.3036. The pair is expected to find its first resistance at 1.3199, and a rise through could take it to the next resistance level of 1.3244.

Trading trend in the Pound today is expected to be determined by the release of UK’s industrial and manufacturing production data along with construction output and total trade balance data, all for August, slated to release in a few hours. Also, traders would eye UK’s NIESR GDP estimate for the three months to September, due to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.