For the 24 hours to 23:00 GMT, the GBP rose 0.46% against the USD and closed at 1.5740, as the UK ILO employment figures outpaced forecasts in March.

Yesterday, data indicated that UK unemployment rate fell to a 7-year low reading of 5.5% in the January to March period, from a 5.6% reading registered in the December-February 2015 period. Additionally, average earnings excluding bonus rose 2.20% YoY in the first quarter of 2015, beating market expectations for an advance of 2.10% and compared to a revised increase of 1.9% registered in the previous quarter.

Gains in the Pound were trimmed, after the BoE, in its quarterly inflation report, revised its growth forecasts lower and added that the UK inflation was likely to fall below zero in coming months.

The UK central bank trimmed its 2015 GDP forecast to 2.5% from its earlier projection of 2.9% in February. Additionally, it also cut its projections for 2016 and 2017 to 2.6% and 2.4% respectively. Meanwhile, the BoE raised the Britain’s inflation forecast to 0.6% from 0.5% in 2015 and to 1.6% from 1.8% in 2016.

In a statement accompanying the quarterly report, the BoE Chief, Mark Carney mentioned that Britain’s inflation would return to its 2% target in two years’ time and signalled that interest rates will not rise until the middle of next year.

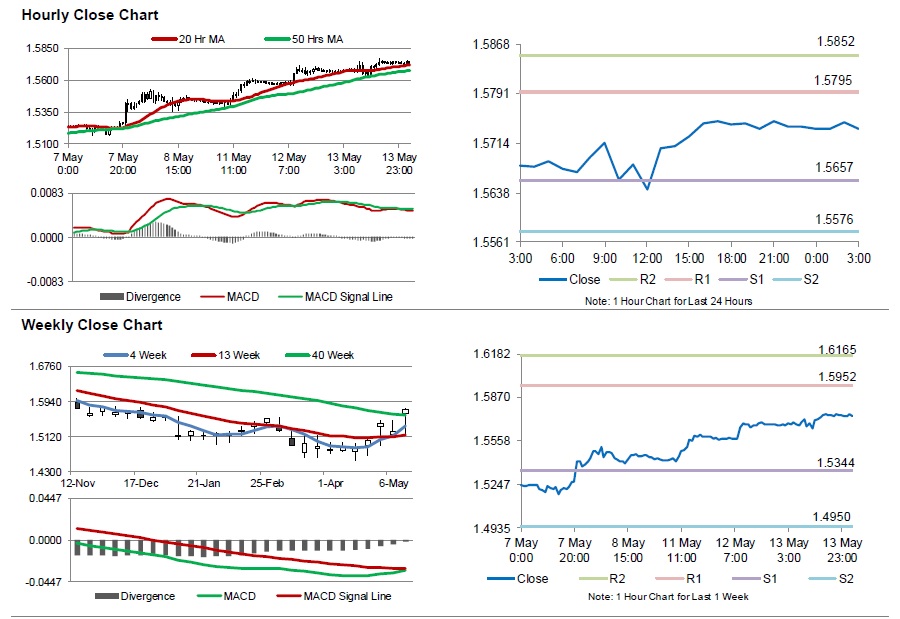

In the Asian session, at GMT0300, the pair is trading at 1.5738, with the GBP trading 0.02% lower from yesterday’s close.

The pair is expected to find support at 1.5657, and a fall through could take it to the next support level of 1.5576. The pair is expected to find its first resistance at 1.5795, and a rise through could take it to the next resistance level of 1.5852.

Amid no economic releases in the UK today, investor sentiment would be governed by global macroeconomic news.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.