For the 24 hours to 23:00 GMT, the GBP rose 0.94% against the USD and closed at 1.5383, after the BoE Governor, Mark Carney signalled that the central bank remained on course to raise interest rate in Britain next year, despite sliding inflation in the nation. He also added that the BoE is closely monitoring the UK economy and stands ready to cut its key interest rate further below its ultra-low level of 0.5%, if economic growth and inflation prospects deteriorate in the nation.

Meanwhile, the BoE in its quarterly inflation report indicated that it expected UK inflation to fall below zero in the coming months due to declining oil prices, but would be back to its 2% target by 2017. Additionally, the report also revealed that the central bank upgraded its forecast for the UK growth in 2016 to 2.9% from its previous estimation of 2.6% and in 2017 to 2.7%, up from 2.6%.

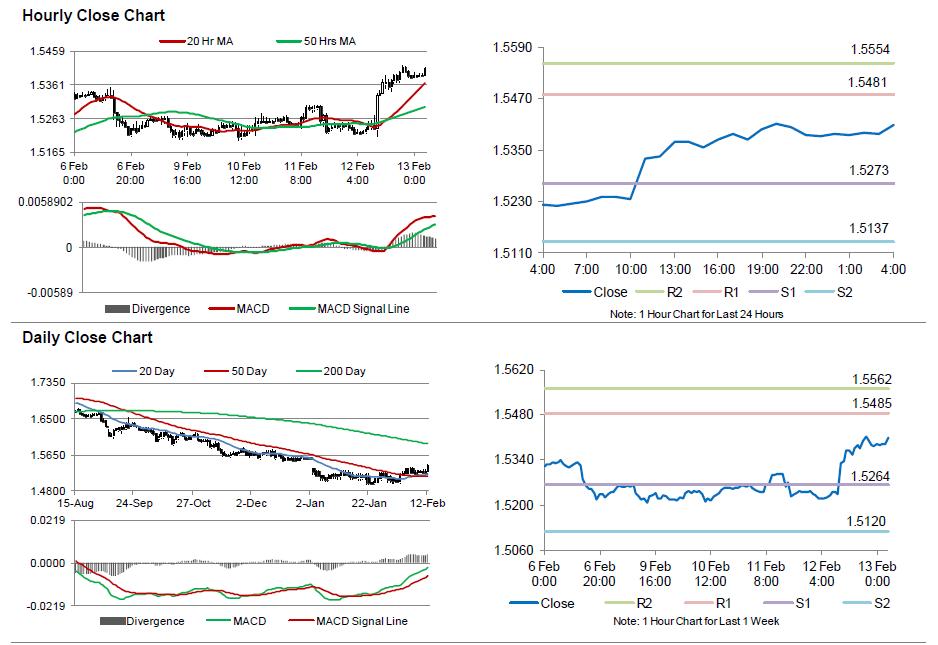

In the Asian session, at GMT0400, the pair is trading at 1.5409, with the GBP trading 0.17% higher from yesterday’s close.

The pair is expected to find support at 1.5273, and a fall through could take it to the next support level of 1.5137. The pair is expected to find its first resistance at 1.5481, and a rise through could take it to the next resistance level of 1.5554.

Amid a light economic calendar in the UK today, investors await the release of Britain’s CB leading economic index data, scheduled in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.