For the 24 hours to 23:00 GMT, the GBP fell 0.92% against the USD and closed at 1.5460, following mixed economic data in the UK.

Data released showed that industrial production in the nation unexpectedly jumped 0.4% MoM in May, following an increase of 0.3% in the preceding month, while manufacturing production retreated 0.6% in the same period, reversing market expectations of a 0.1% rise and compared to a fall of 0.4% in April.

Separately, the NIESR estimated that the UK economy expanded at a pace of 0.7% in the three months to June, higher than 0.6% growth in the three months ended May. The upbeat assessment of the UK economy has renewed expectations that the BoE is inching closer towards an interest rate hike.

In the Asian session, at GMT0300, the pair is trading at 1.5433, with the GBP trading 0.17% lower from yesterday’s close.

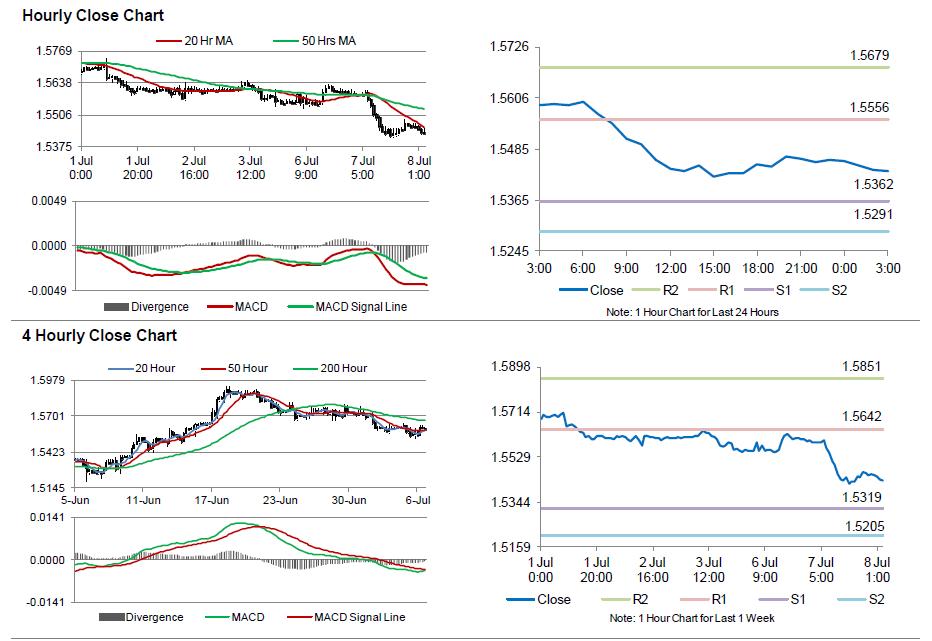

The pair is expected to find support at 1.5362, and a fall through could take it to the next support level of 1.5291. The pair is expected to find its first resistance at 1.5556, and a rise through could take it to the next resistance level of 1.5679.

Looking ahead, the BoE’s crucial interest rate decision scheduled tomorrow would generate a lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.