For the 24 hours to 23:00 GMT, the GBP fell 0.14% against the USD and closed at 1.2439, after the British Prime Minister, Theresa May triggered Article 50 and formally began Britain’s divorce from the European Union. She declared that there was no turning back and ushered in an exit process that will pitch her country into an unknown territory.

On the economic front, UK’s net consumer credit rose more-than-expected by GBP1.4 billion, compared to a revised advance of GBP1.6 billion in the previous month. On the other hand, the nation’s mortgage approvals recorded a surprise drop to a level of 68.3K in February, from a revised reading of 69.1K in the previous month.

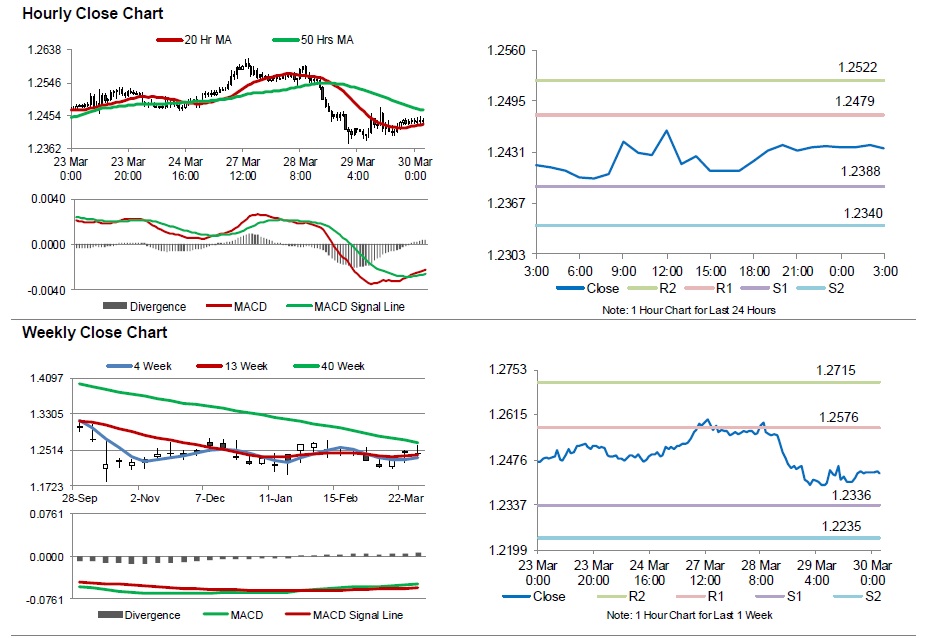

In the Asian session, at GMT0300, the pair is trading at 1.2436, with the GBP trading marginally lower against the US Dollar from yesterday’s close.

The pair is expected to find support at 1.2388, and a fall through could take it to the next support level of 1.2340. The pair is expected to find its first resistance at 1.2479, and a rise through could take it to the next resistance level of 1.2522.

Going ahead, investors await the UK’s GfK consumer confidence index for March, scheduled to release overnight.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.