For the 24 hours to 23:00 GMT, the GBP rose 0.31% against the USD and closed at 1.7142, after the UK inflation data rose 1.9% on a yearly basis in June, closer to the BoE’s 2% target and compared to an expected rise of 1.6%. Meanwhile, the producer output price inflation advanced 1.0% in the UK on a yearly basis in June, at par with market expectations. Additionally, an official survey revealed that the house prices in the UK climbed 10.5% in May, while house prices in London reported a 20% rise, the largest increase since 2002.

Yesterday, the BoE Governor, Mark Carney reiterated that the key interest rate in the UK could rise sooner than expected, however an exact time cannot be determined as the monetary policy ahead would solely depend upon the economic data from the nation.

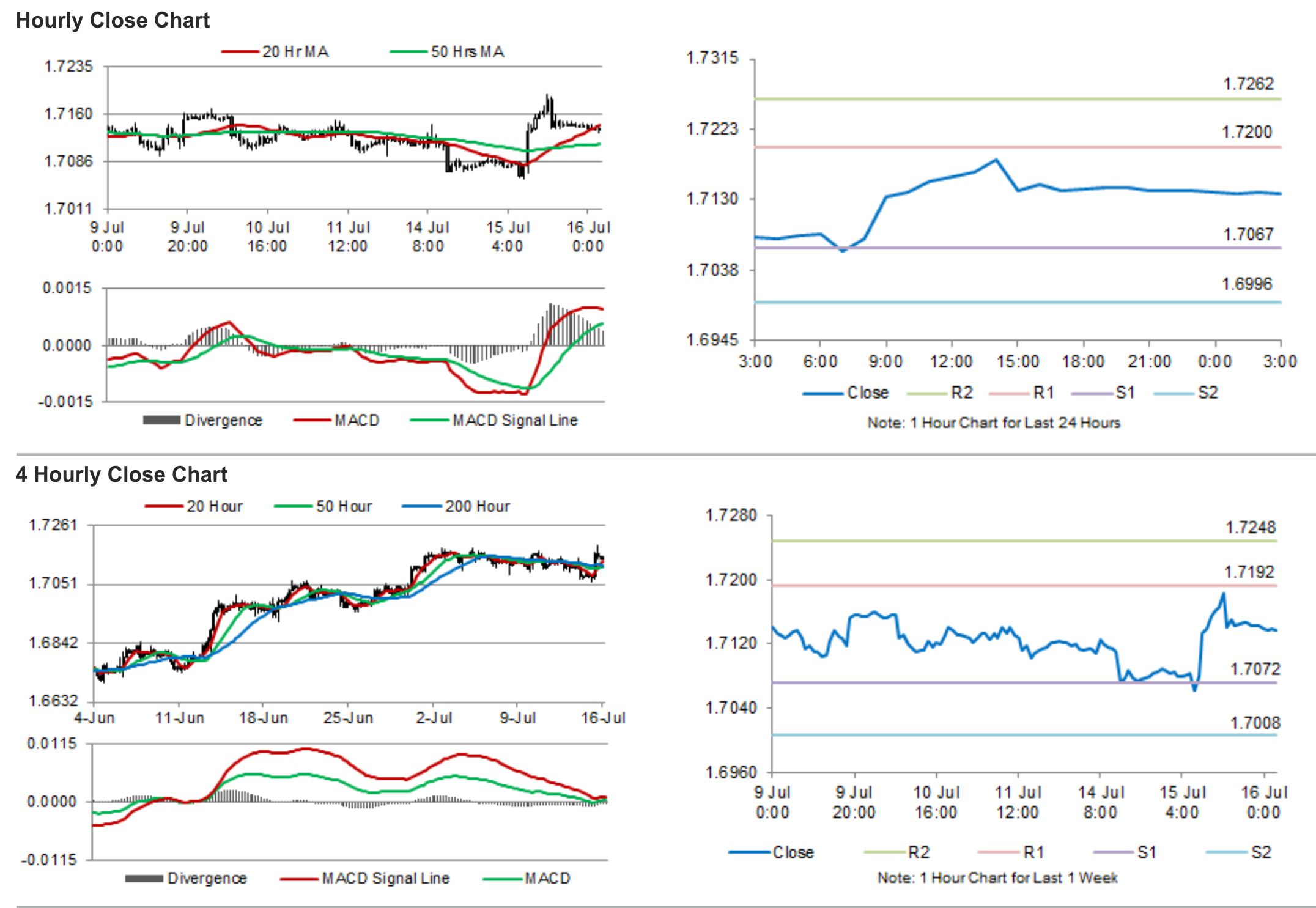

In the Asian session, at GMT0300, the pair is trading at 1.7137, with the GBP trading tad lower from yesterday’s close.

The pair is expected to find support at 1.7067, and a fall through could take it to the next support level of 1.6996. The pair is expected to find its first resistance at 1.72, and a rise through could take it to the next resistance level of 1.7262.

Trading trends in the Pound today are expected to be determined by the release of claimant count and unemployment rate data from the UK.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.