For the 24 hours to 23:00 GMT, GBP rose 0.12% against the USD and closed at 1.5504.

However, gains were limited after Bank of England Governor, Mervyn King stated that the Euro-zone crisis was likely to cause UK’s economy to stagnate over the next six months, and that he was particularly concerned about the effect on UK’s banks.

The British Chambers of Commerce has cut the growth outlook for the country’s economy and stated that the impact of the Euro-zone debt crisis has been more serious than previously expected.

In economic news, the Confederation of British Industry (CBI) in its Distributive Trades Survey indicated that the retail sales balance in the UK stood at -19.0% in November, compared to -11.0% in October.

In the Asian session, at GMT0400, the pair is trading at 1.5501, with the GBP trading marginally lower from yesterday’s close.

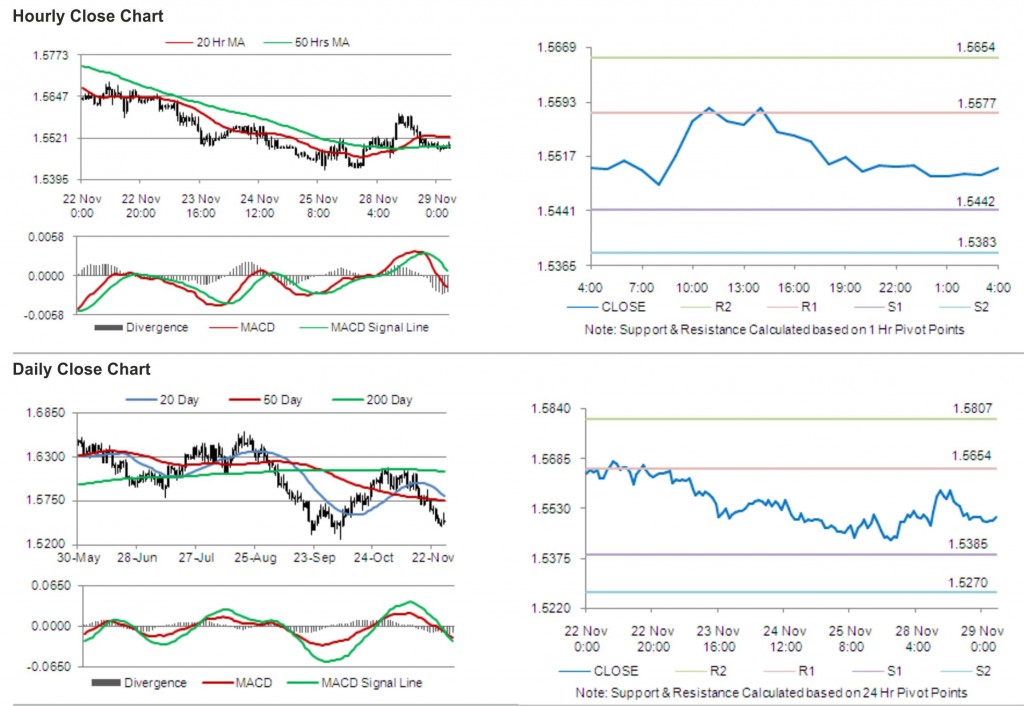

The pair is expected to find support at 1.5442, and a fall through could take it to the next support level of 1.5383. The pair is expected to find its first resistance at 1.5577, and a rise through could take it to the next resistance level of 1.5654.

Trading trends in the pair today are expected to be determined by release of money supply and mortgage approvals data in the UK.

The currency pair is showing convergence with its 50 Hr moving average and is trading below its 20 Hr moving average.