For the 24 hours to 23:00 GMT, GBP rose marginally against the USD and closed at 1.6214.

The Bank of England Markets Director Paul Fisher stated that officials have not ruled out adding to their bond-purchase program if needed to support the economy.

In the UK, the public sector net borrowing, on an annual basis, declined £1.1 billion to £17.4 billion in May. Meanwhile, the central government’s net cash requirement stood at £10.8 billion in May, a £7.2 billion lower net cash requirement than in the same period last year.

Additionally, the Confederation of British Industry’s industrial trends survey reported that 27.0% of the manufacturers indicated that total orders were above normal in June, while 26.0% of the manufacturers indicated that total orders were below normal in June, thereby resulting in a positive balance of 1.0%. The balance was higher than the market estimate of -5.0% for June. The survey indicated that a balance of 13.0% expects output to grow over the coming three months.

The pair opened the Asian session at 1.6214, and is trading at 1.6216 at 3.00GMT. The pair is trading flat from yesterday’s close at 23:00 GMT.

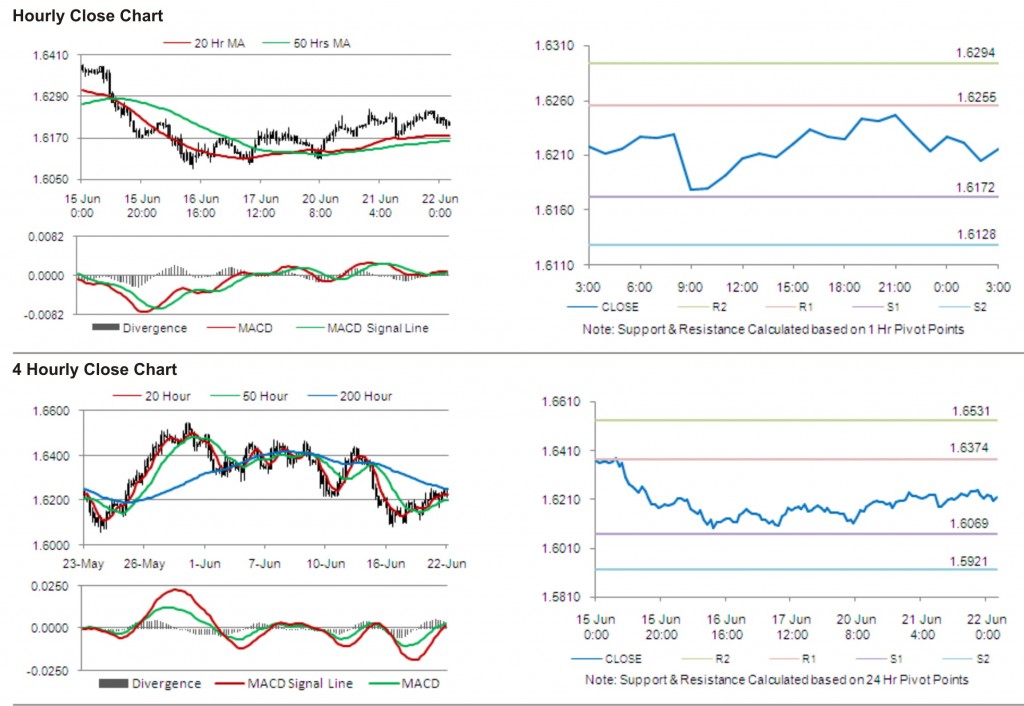

The pair has its first short term resistance at 1.6255, followed by the next resistance at 1.6294. The first support is at 1.6172, with the subsequent support at 1.6128.

Investors are eying the Bank of England minutes to be released later today.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.