For the 24 hours to 23:00 GMT, GBP fell 0.21% against the USD and closed at 1.6034, after the UK banks reported an unexpected increase in mortgage defaults.

According to the Bank of England’s latest Credit Conditions Survey, the default rate on mortgages increased unexpectedly in the first quarter of 2011, compared to the previous three months.

Meanwhile, the Nationwide Building Society reported that average house prices rose 0.5% in March and a revised 0.7% in February.

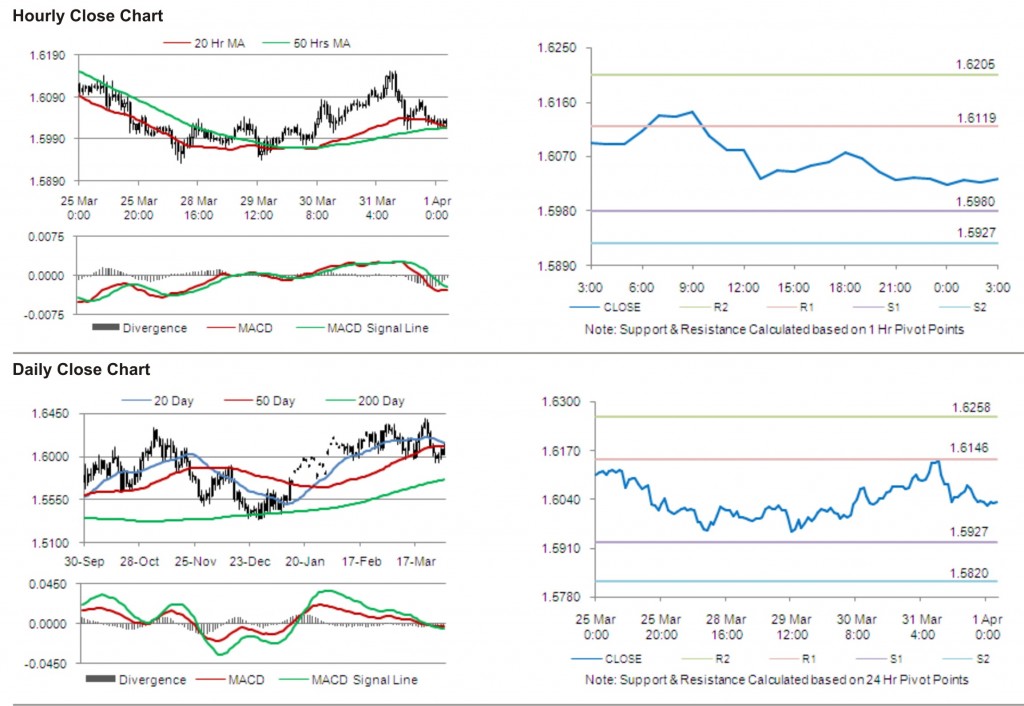

In the Asian session, at 3:00GMT, the GBPUSD is trading flat at 1.6034, from the levels yesterday at 23:00GMT.

The pair has its first short term resistance at 1.6119, followed by the next resistance at 1.6205. The first support is at 1.5980, with the subsequent support at 1.5927.

Trading trends in the pair today are expected to be determined by data release on Halifax house prices in the UK.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.