For the 24 hours to 23:00 GMT, GBP fell 0.21% against the USD and closed at 1.6026. Pound remained under pressure, after a day before yesterday’s minutes of the last BOE meeting, which suggested that the Bank would think about a further round of QE if the economy does not pick up.

In the US, the initial jobless claims for state unemployment insurance increased to 429000 in the week ending June 17 from the previously registered 420000. Meanwhile, the continuing jobless claims fell to 3.697 million, compared to the preceding week’s revised level of 3.698 million.

In the UK, the British Bankers’ Association (BBA) reported that, on a seasonally adjusted basis, mortgage approvals increased to 30,509 in May, compared an upwardly revised 29,747 approvals recorded in April. Meanwhile, the confederation of British Industry (CBI) indicated that the distributive trade survey’s balance dropped to a level of -2.0 in June, following a score of 18.0 posted in May.

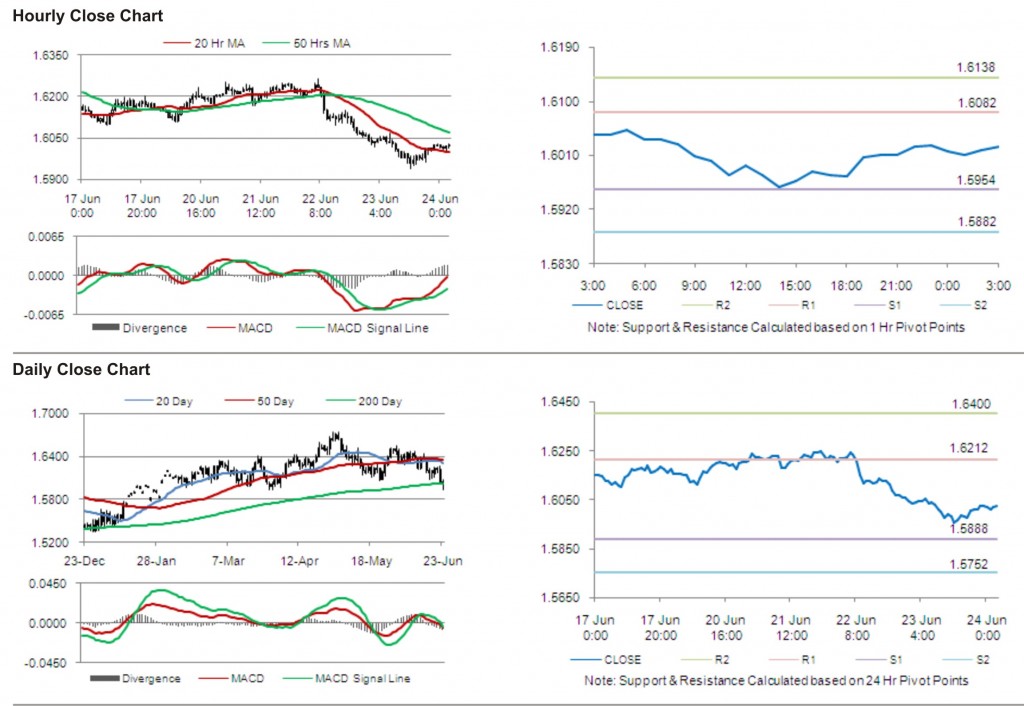

The pair opened the Asian session at 1.6026, and is trading at 1.6025 at 3.00GMT. The pair is trading flat from yesterday’s close at 23:00 GMT.

The pair has its first short term resistance at 1.6082, followed by the next resistance at 1.6138. The first support is at 1.5954, with the subsequent support at 1.5882.

The currency pair is trading between its 20 Hr and its 50 Hr moving averages.