For the 24 hours to 23:00 GMT, GBP fell 0.63% against the USD and closed at 1.6349.

The IMF’s annual economic assessment of the UK indicates that economic recovery is broadly on track, though the UK may need to consider more QE or temporary tax cuts in case weak growth persists.

In the UK, the same store sales, on annual basis, declined by 2.1% in May, following a 5.2% rise in April.

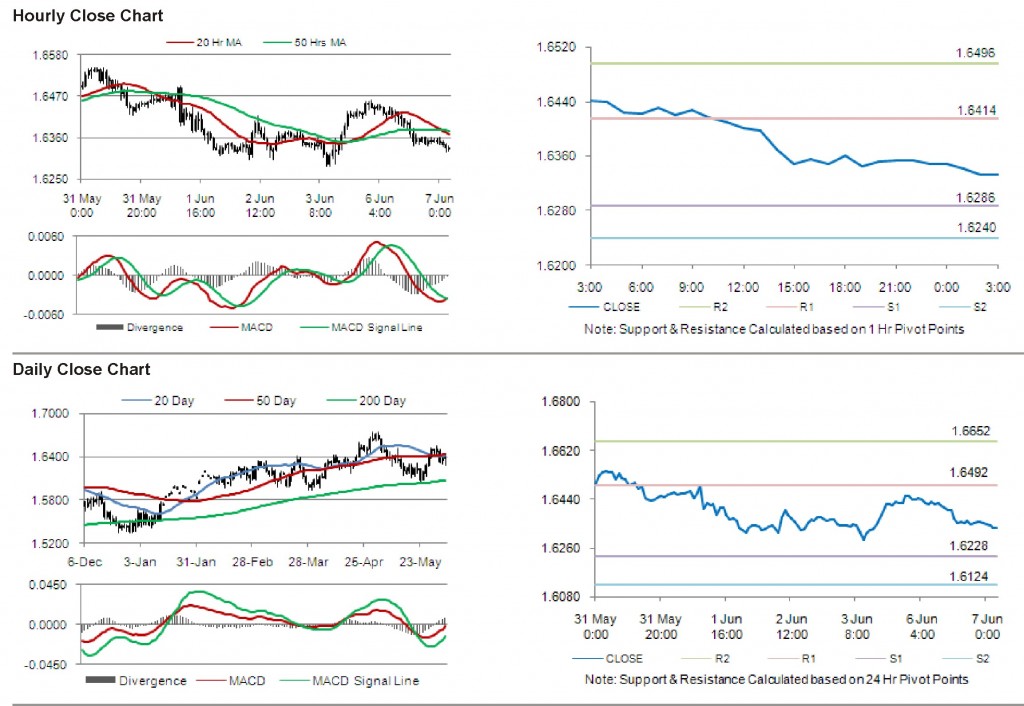

The pair opened the Asian session at 1.6349, and is trading at 1.6333 at 3.00GMT. The pair is trading 0.10% lower from yesterday’s close at 23:00 GMT.

The pair has its first short term resistance at 1.6414, followed by the next resistance at 1.6496. The first support is at 1.6286, with the subsequent support at 1.6240.

Trading trends in the pair today are expected to be determined by release of BRC shop price index in the UK.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.