For the 24 hours to 23:00 GMT, the GBP marginally fell against the USD and closed at 1.6627 after official data showed that construction PMI for the UK economy edged down to a reading of 62.5 in March, contradicting analysts’ call for rise to 63.0, from a previous month’s reading of 62.6. Separately, Nationwide said that house prices in the UK rose 0.4% (MoM) in February, less than market expectations for a 0.8% rise and compared to a 0.7% increase registered in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.6650, with the GBP trading 0.14% higher from yesterday’s close.

Meanwhile, BoE Governor, Mark Carney, in an interview with the ‘The Northern Echo’ newspaper, stated that interest rates in the nation may rise before the next UK election, provided the recovery witnessed by London must spread across the nation and create more jobs in the rest of the country. He further added that the interest rate hike would be “gradual” even though Britain’s economy is growing faster than any of the world’s developed nations.

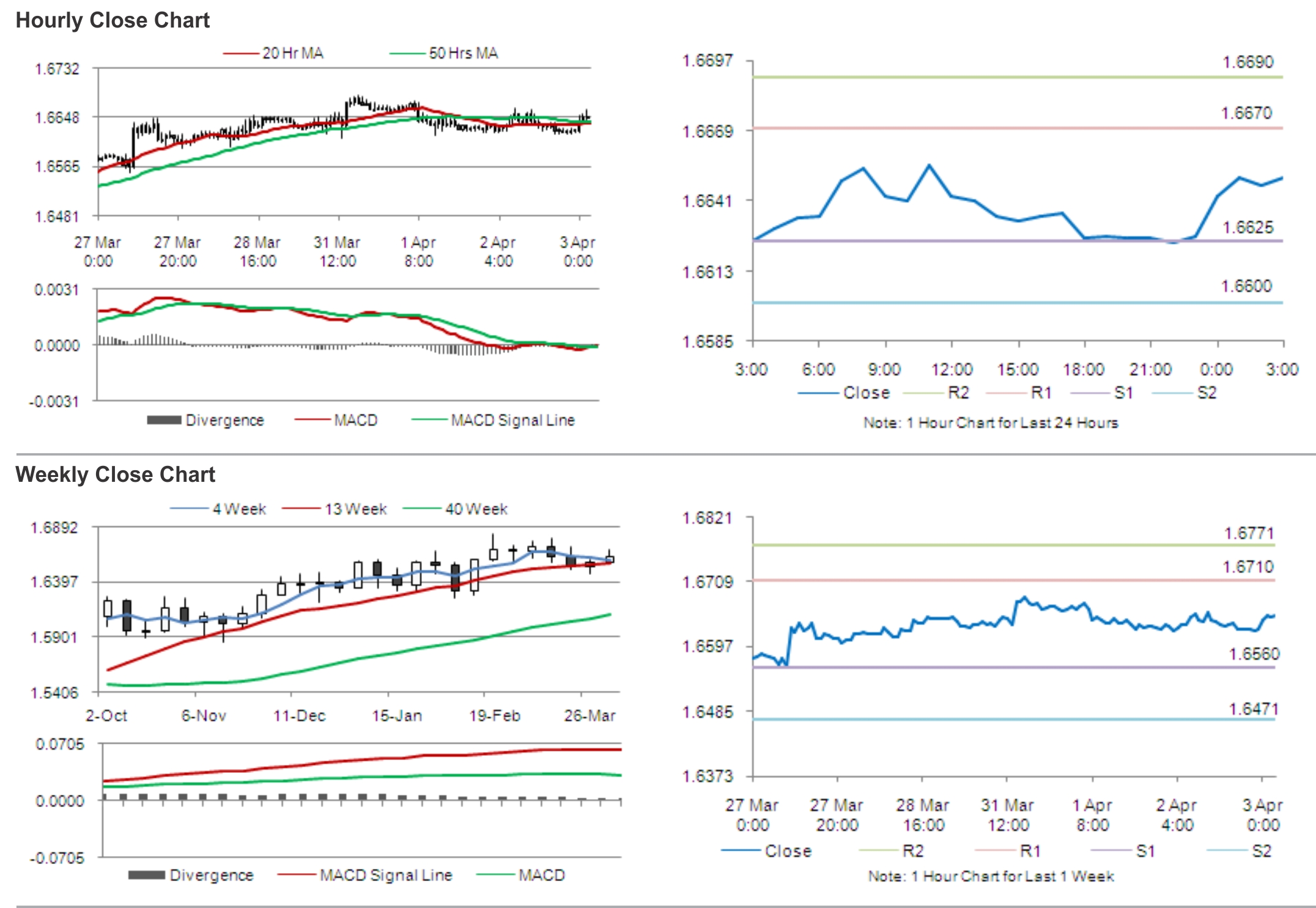

The pair is expected to find support at 1.6625, and a fall through could take it to the next support level of 1.6600. The pair is expected to find its first resistance at 1.6670, and a rise through could take it to the next resistance level of 1.6690.

Market participants are expected to keep a tab on Markit Economics’ PMI report on UK’s service sector, slated for release later today.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.