For the 24 hours to 23:00 GMT, the GBP rose 1.18% against the USD and closed at 1.3340.

Macroeconomic data indicated that the U.K.’s construction PMI dropped at the steepest pace in seven years to a level of 45.9 in July, contracting for the second consecutive month, following uncertainty over the historic Brexit vote. Markets expected it to fall to a level of 44.0 and after recording a reading of 46.0 in the prior month.

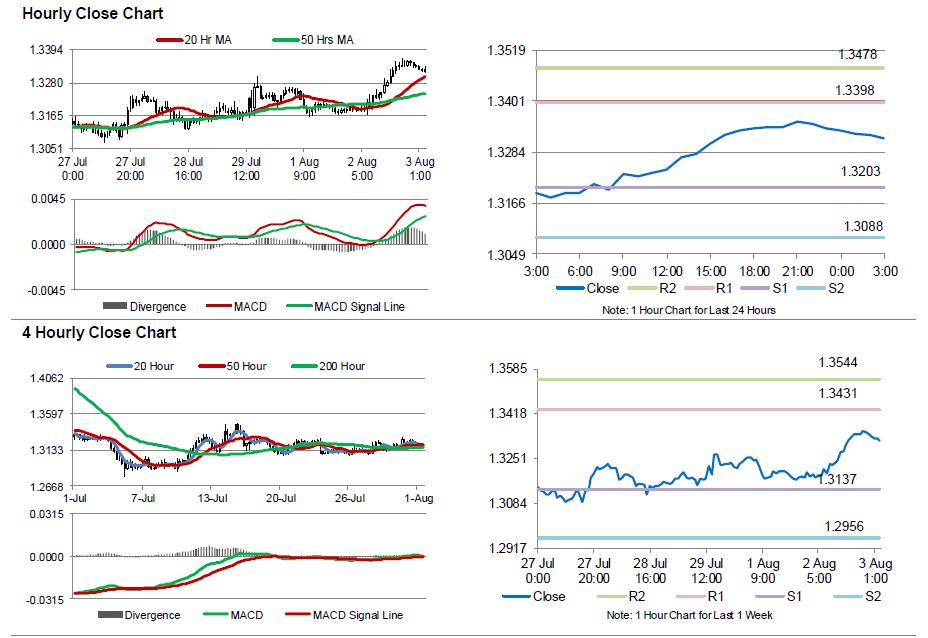

In the Asian session, at GMT0300, the pair is trading at 1.3317, with the GBP trading 0.17% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.3203, and a fall through could take it to the next support level of 1.3088. The pair is expected to find its first resistance at 1.3398, and a rise through could take it to the next resistance level of 1.3478.

Moving ahead, investors will closely monitor UK’s final Markit services PMI for July, scheduled to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.