For the 24 hours to 23:00 GMT, the GBP rose 0.08% against the USD and closed at 1.6588, on upbeat UK data.

The CBI reported that the index of UK retailers climbed to a reading of 37.0 in August, a six-month high, more than market estimates of a reading of 27.0 and compared to 21.0 registered in July. On the other hand, the Lloyds Bank reported that the business barometer in the UK fell to a level of 47.0, in August, following a reading of 52.0 in the previous month.

Meanwhile, the British Chambers of Commerce indicated that the British economy will grow by 3.2% in 2014, its fastest rate since 2007 and by 2.8% in 2015.

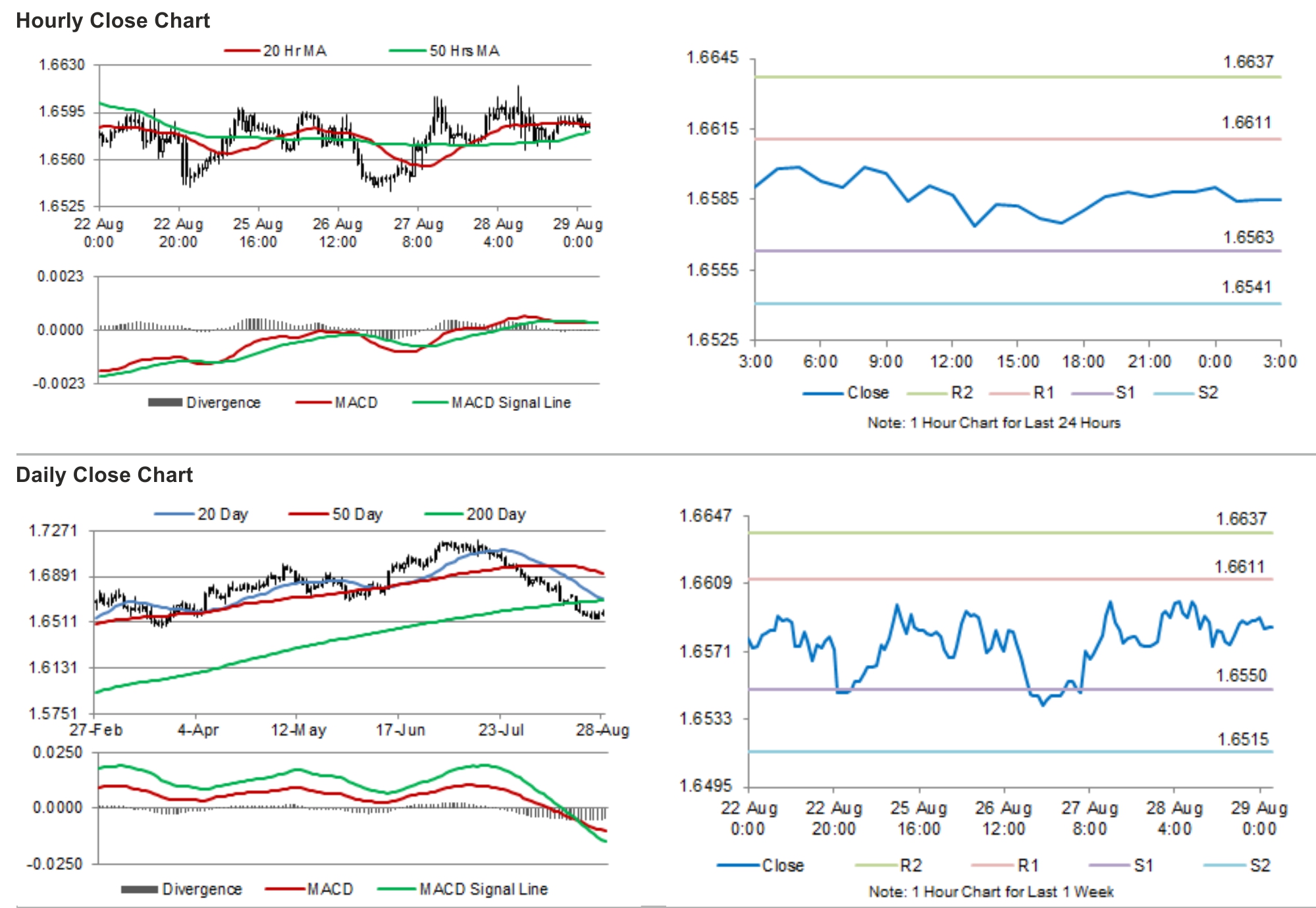

In the Asian session, at GMT0300, the pair is trading at 1.6585, with the GBP trading 0.02% lower from yesterday’s close.

In economic news, the consumer confidence in the UK edged up more than expected in August. The GfK consumer confidence index rose to 1.0, beating market estimates of an advance to a level of -1.0 and compared to a level of -2.0 in the previous month. Additionally, the seasonally adjusted Hometrack House Price growth in the UK advanced 0.1% in August, compared to a similar rise registered in the previous month.

The pair is expected to find support at 1.6563, and a fall through could take it to the next support level of 1.6541. The pair is expected to find its first resistance at 1.6611, and a rise through could take it to the next resistance level of 1.6637.

Going forward, trading trends in the Pound today are expected to be mainly determined by the release of the Nationwide house price index.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.