For the 24 hours to 23:00 GMT, the GBP rose 0.58% against the USD and closed at 1.2488, after UK’s net consumer credit surged to an eleven year high of £1.62 billion in October, offering further evidence that the economy is holding up post the Brexit vote. Markets expected it to advance by £1.50 billion, compared to a revised rise of £1.48 billion in the previous month. Additionally, the nation’s mortgage approvals for house purchases increased more-than-expected to a level of 67.5K in October, marking its highest level in seven months, compared to a revised level of 63.6K in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.2477, with the GBP trading 0.09% lower against the USD from yesterday’s close.

Overnight data showed that the nation’s GfK consumer confidence index dropped more-than-anticipated to a level of -8.0 in November, highlighting that Britons grew more anxious about UK’s growth prospects. The index recorded a reading of -3.0 in the prior month, whereas investors had envisaged for it to ease to a level of -4.0.

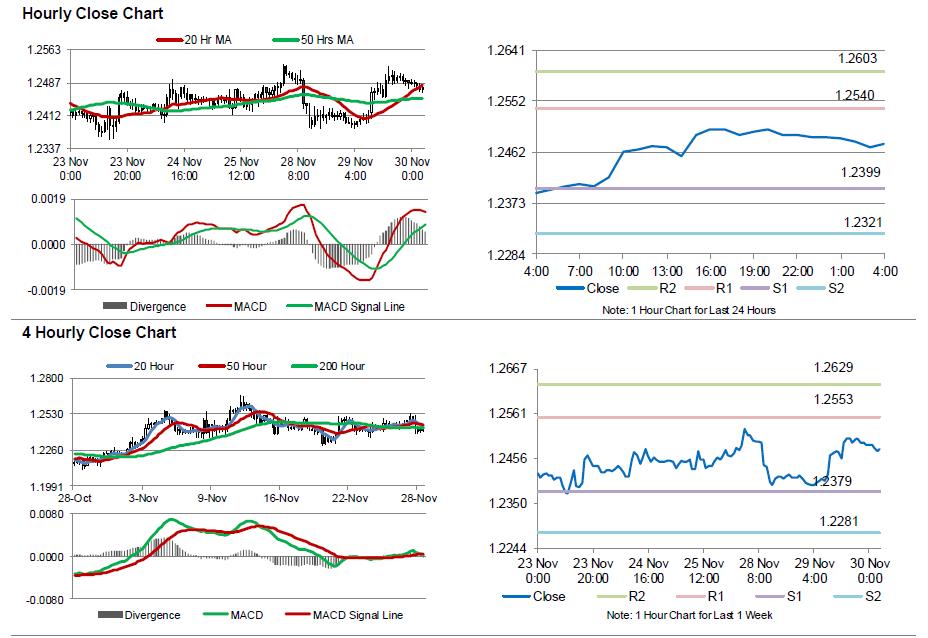

The pair is expected to find support at 1.2399, and a fall through could take it to the next support level of 1.2321. The pair is expected to find its first resistance at 1.254, and a rise through could take it to the next resistance level of 1.2603.

Moving ahead, UK’s financial stability report, scheduled to release in a few hours, would be on investor’s radar.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.