For the 24 hours to 23:00 GMT, the GBP rose 0.19% against the USD and closed at 1.4152 on Friday, as better-than-expected UK GDP numbers added to the bullish mood amongst investors.

Data indicated that Britain’s flash gross domestic product (GDP) advanced more-than-estimated by 0.5% on a quarterly basis in the final three months of 2017, adding to the view that the economy has performed better than many feared in the wake of the Brexit vote. The nation’s GDP had climbed 0.4% in the prior quarter, while markets had expected for a rise of 0.4%.

Separately, the Bank of England (BoE) Governor, Mark Carney, at the World Economic Forum in Davos, stated that the outcome of Brexit negotiations with the European Union (EU) would determine the path of interest rate hikes in UK over the next year.

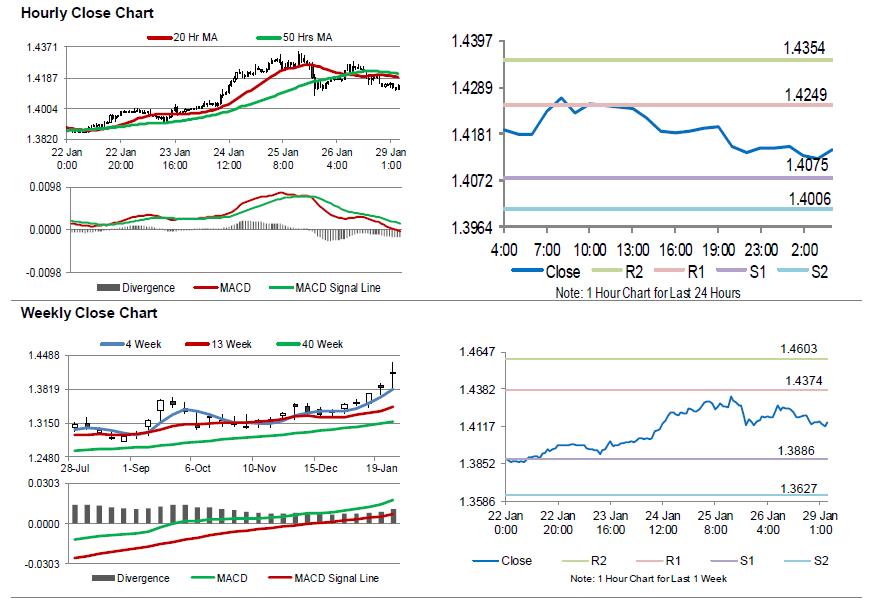

In the Asian session, at GMT0400, the pair is trading at 1.4144, with the GBP trading 0.06% lower against the USD from Friday’s close.

The pair is expected to find support at 1.4075, and a fall through could take it to the next support level of 1.4006. The pair is expected to find its first resistance at 1.4249, and a rise through could take it to the next resistance level of 1.4354.

With no macroeconomic releases in UK today, investor sentiment would be governed by global macroeconomic factors.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.