On Friday, GBP marginally rose 0.56% against the USD and closed at 1.5163, following stronger than expected manufacturing production in the UK.

Britain’s manufacturing production rebounded to a 7-month high of 0.7% on a MoM basis in November, beating market forecast for a 0.3% rise. It had eased 0.7% in the preceding month.

On the other hand, the nation’s industrial production unexpectedly shrank 0.1% on a MoM basis in November, compared to a revised fall of 0.3% in October, while markets were anticipating industrial production to advance 0.2%. Meanwhile, the UK’s total trade deficit narrowed to £1.41 billion in November, following a revised total trade deficit of £2.25 billion in the previous month.

Furthermore, the NIESR projected GDP for the UK economy slowed to 0.6% on a monthly basis in the October-December 2014 period. NIESR estimated GDP had registered a rise of 0.70% in the July-September 2014 period.

In the Asian session, at GMT0400, the pair is trading at 1.5166, with the GBP trading a tad higher from Friday’s close.

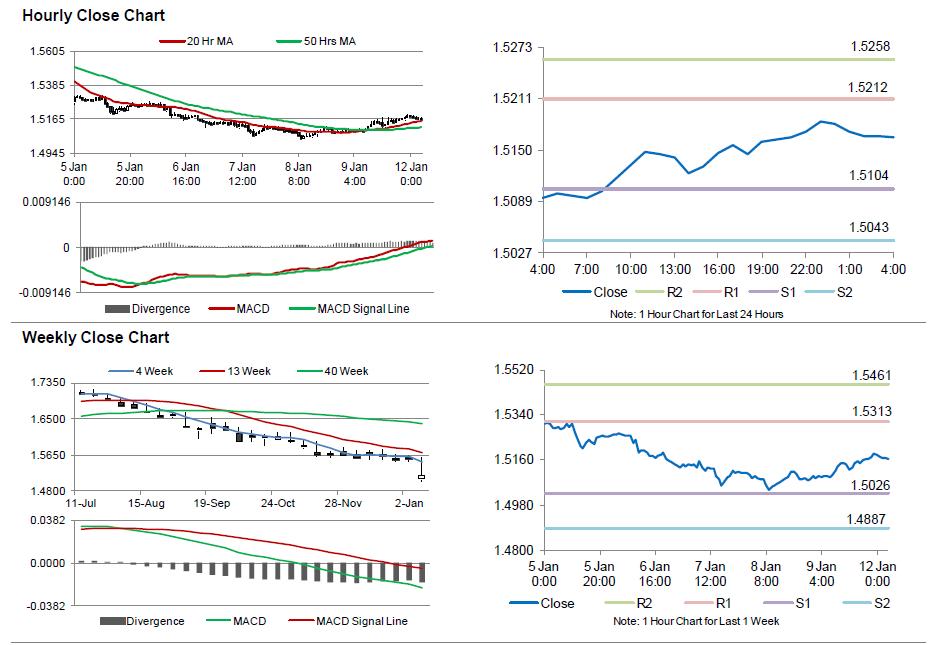

The pair is expected to find support at 1.5104, and a fall through could take it to the next support level of 1.5043. The pair is expected to find its first resistance at 1.5212, and a rise through could take it to the next resistance level of 1.5258.

Going forward, investors would closely watch Britain’s consumer prices data, slated for tomorrow’s release.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.