For the 24 hours to 23:00 GMT, the GBP rose 0.20% against the USD and closed at 1.3284.

Yesterday, the Paris based think tank, OECD raised Britain’s growth outlook to 1.4% this year and to 1.3% in 2019, revised up from 1.3% and 1.1% respectively. However, it added that economic expansion would remain modest, in the wake of uncertainty from the Brexit negotiations.

In the Asian session, at GMT0300, the pair is trading at 1.3299, with the GBP trading 0.11% higher against the USD from yesterday’s close.

Overnight data showed that UK’s GfK consumer confidence index improved to a level of -7.0 in May, surging to its highest level since May 2017, compared to a level of -9.0 in the previous month. Market participants had expected the index to climb to a level of -8.0. Additionally, the nation’s Lloyds business barometer rose to 35.0 in May, after registering a reading of 32.0 in the prior month.

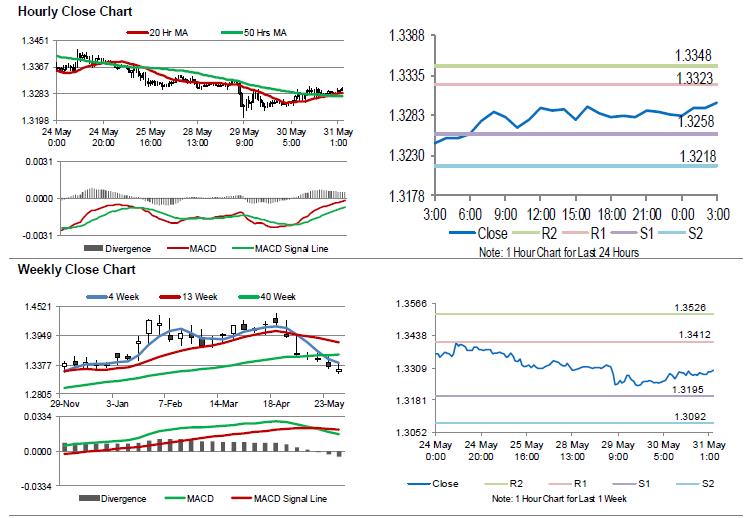

The pair is expected to find support at 1.3258, and a fall through could take it to the next support level of 1.3218. The pair is expected to find its first resistance at 1.3323, and a rise through could take it to the next resistance level of 1.3348.

Going ahead, investors will keep a watch on UK’s Nationwide house price index for May as well as net consumer credit and mortgage approvals data, both for April, slated to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.