For the 24 hours to 23:00 GMT, the GBP declined 4.88% against the USD and closed at 1.2392.

On the data front, UK’s seasonally adjusted Nationwide house prices rose 3.0% on a yearly basis in March, registering its fastest growth since January 2018, more than market forecast for a rise of 2.0%. In the previous month, house prices had recorded a rise of 2.3%.

In the Asian session, at GMT0300, the pair is trading at 1.2379, with the GBP trading 0.10% lower against the USD from yesterday’s close.

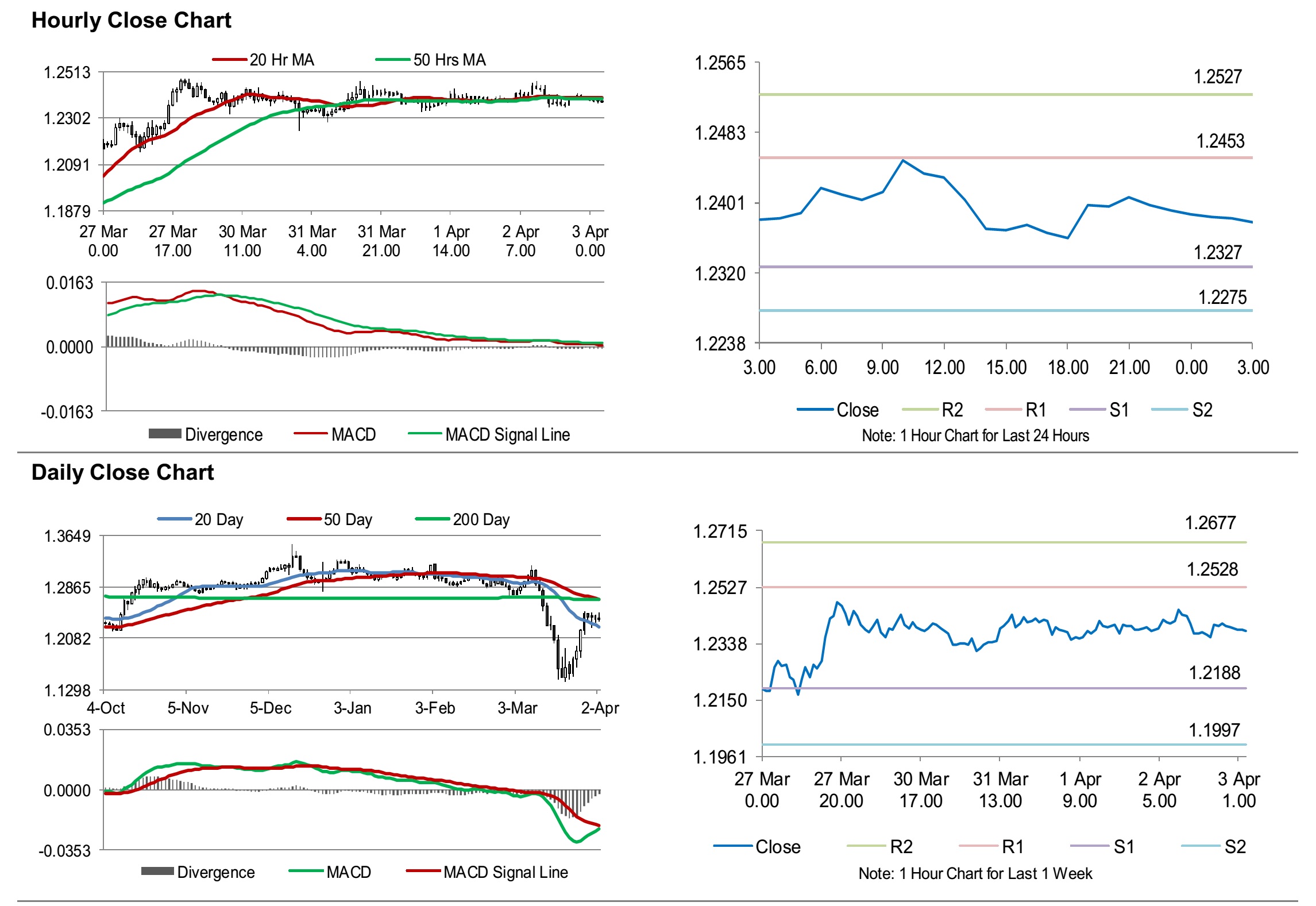

The pair is expected to find support at 1.2327, and a fall through could take it to the next support level of 1.2275. The pair is expected to find its first resistance at 1.2453, and a rise through could take it to the next resistance level of 1.2527.

Moving ahead, traders would keep a close watch on UK’s Markit services PMI for March, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.