For the 24 hours to 23:00 GMT, the GBP declined 0.40% against the USD and closed at 1.2647, after UK’s manufacturing sector activity unexpectedly eased to a six-year low level of 48.0 in June, reflecting the impact of Brexit and economic slowdown. In the previous month, the PMI had recorded a reading of 49.4. Market participants had expected the PMI to rise to a level of 49.5. Moreover, the nation’s mortgage approvals for house purchases dropped to a level of 65.4K in May, compared to a revised level of 66.0K in the prior month. Markets had envisaged mortgage approvals for house purchases to register a decline to a level of 65.6K.

On the contrary, Britain’s net consumer credit advanced £0.8 billion in May, rising at its slowest annual pace in five years and less than market anticipation for a gain of £0.9 billion. In the previous month, net consumer credit had recorded a revised rise of £1.0 billion.

In the Asian session, at GMT0300, the pair is trading at 1.2641, with the GBP trading 0.05% lower against the USD from yesterday’s close.

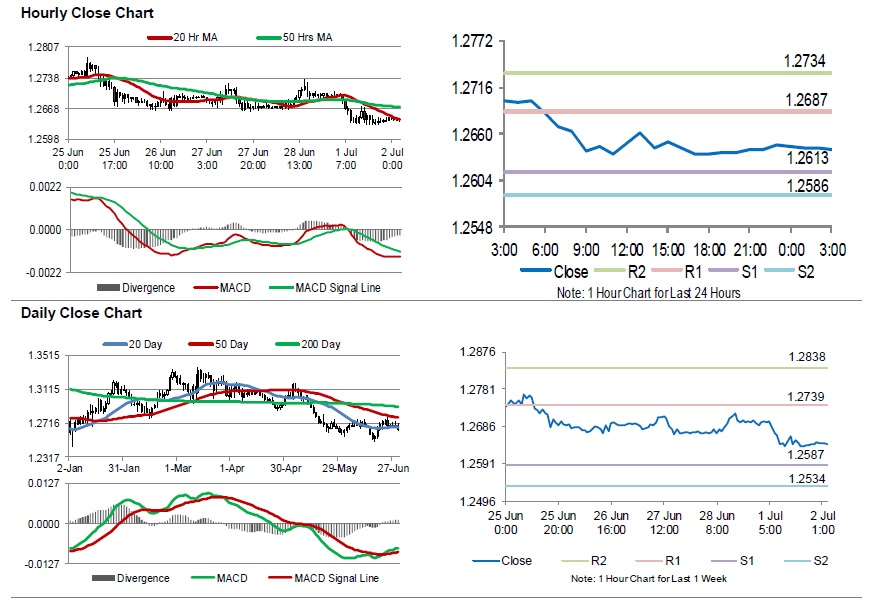

The pair is expected to find support at 1.2613, and a fall through could take it to the next support level of 1.2586. The pair is expected to find its first resistance at 1.2687, and a rise through could take it to the next resistance level of 1.2734.

Looking ahead, traders would await UK’s Nationwide house price index and the Markit construction PMI, both for June, set to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.