For the 24 hours to 23:00 GMT, the GBP declined 1.0% against the USD and closed at 1.3757, as Brexit talks with the European Union’s (EU) hit another stumbling block, after the UK Prime Minister, Theresa May, rejected EU’s draft of Brexit withdrawal agreement.

The EU suggested to keep British-ruled Northern Ireland in a customs union if a solution to the border dispute cannot be found.

Additionally, EU’s chief negotiator, Michel Barnier, warned that a Brexit transition deal was not guaranteed and that negotiations on a post-Brexit transition period had confirmed “significant divergences”. Further, he added that Britain must accelerate the pace of talks if it wants a deal this year.

In the Asian session, at GMT0400, the pair is trading at 1.3759, with the GBP trading marginally higher against the USD from yesterday’s close.

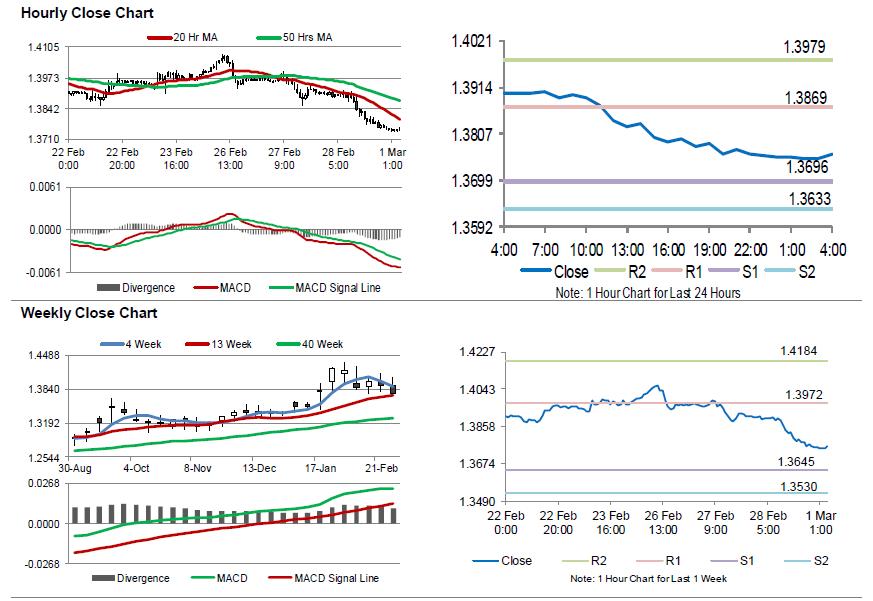

The pair is expected to find support at 1.3696, and a fall through could take it to the next support level of 1.3633. The pair is expected to find its first resistance at 1.3869, and a rise through could take it to the next resistance level of 1.3979.

Going ahead, traders would focus on UK’s net consumer credit and mortgage approvals data both for January coupled with the Nationwide house prices data for February, all slated to release in a few hours, will be on investors’ radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.