For the 24 hours to 23:00 GMT, the GBP slightly rose against the USD and closed at 1.3786 on Friday.

On Friday, Britain’s Prime Minister, Theresa May, in a much-awaited Brexit speech, acknowledged that the UK and the European Union (EU) would have reduced access to each other’s markets after Brexit. However, she insisted that Britain wanted the “broadest and deepest possible agreement” and that the nation was close to agreeing the terms of an implementation period that will help smooth the country’s departure from the EU. Further, she conceded that no side can get exactly what it wants in Brexit negotiations. Commenting on the European Court of Justice jurisdiction, she stated that its existence, and its rulings, will continue to impact the UK.

Separately, data revealed that UK’s Markit construction PMI registered a rise to a level of 51.4 in February, compared to a 4-month low level of 50.2 in the prior month, while investors had envisaged for a rise to a level of 50.5.

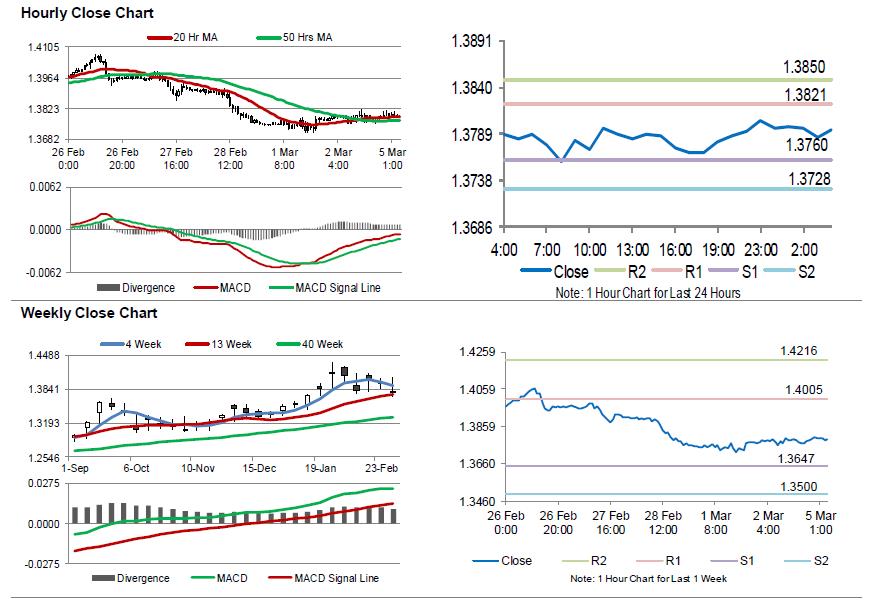

In the Asian session, at GMT0400, the pair is trading at 1.3793, with the GBP trading 0.1% higher against the USD from Friday’s close.

The pair is expected to find support at 1.3760, and a fall through could take it to the next support level of 1.3728. The pair is expected to find its first resistance at 1.3821, and a rise through could take it to the next resistance level of 1.3850.

Trading trend in the Pound today is expected to be determined by the release of UK’s Markit services PMI for February, due in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.