For the 24 hours to 23:00 GMT, the GBP fell 0.10% against the USD and closed at 1.5328, as Britain’s services PMI suffered its sharpest slowdown in nearly four years in May.

Data released showed that UK’s services PMI slipped to a level of 56.5 in May, from 59.5 in April. Markets were expecting the index to ease to a level of 59.2, thus indicating that a recent cooling of the UK economy might last longer than previously thought.

Other economic data showed that UK’s Nationwide house price index’s annual growth rate eased to a 21-month low level of 4.6% YoY in May, following a 5.2% increase in the previous month.

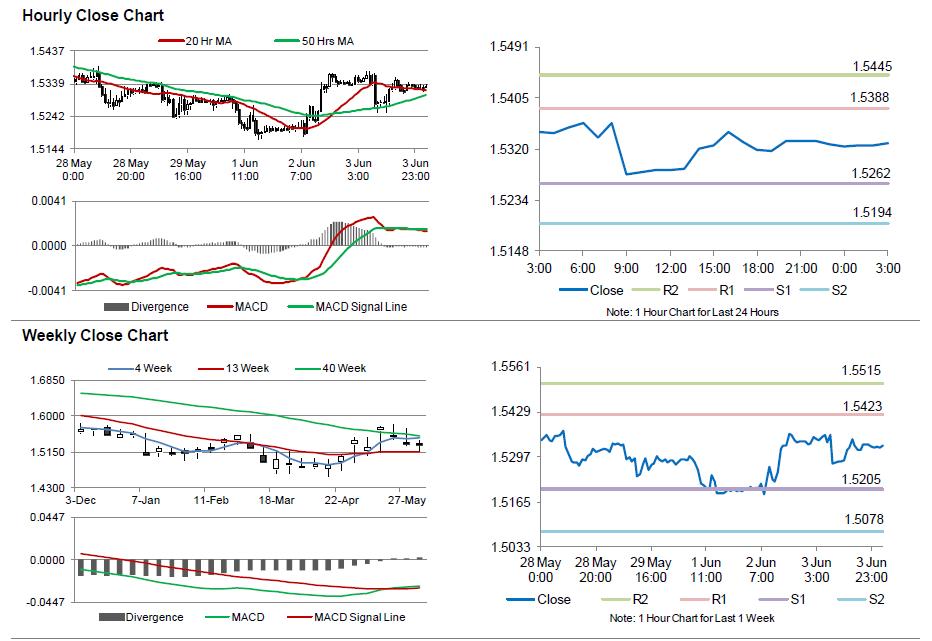

In the Asian session, at GMT0300, the pair is trading at 1.5331, with the GBP trading a tad higher from yesterday’s close.

The pair is expected to find support at 1.5262, and a fall through could take it to the next support level of 1.5194. The pair is expected to find its first resistance at 1.5388, and a rise through could take it to the next resistance level of 1.5445.

Looking ahead, the BoE’s monetary policy meeting, scheduled in a few hours will likely have limited market reaction as the central bank is widely expected to retain its current policy.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.