On Friday, GBP rose 0.17% against the USD and closed at 1.6822.

Late Saturday, the Bank of England (BoE) Governor, Mark Carney, citing large increase in the nation’s mortgage level, cautioned that the Britain’s housing market posed the biggest risk to the “durability” of the nation’s recovery and as a result, policymakers could consider steps such as imposing more checks on the affordability of mortgages, limiting types of loans or advising the government to limit its ‘Help to Buy program’, if needed.

In the Asian session, at GMT0300, the pair is trading at 1.6828, with the GBP trading marginally higher from Friday’s close. Earlier today, the Rightmove reported that its house price index in the UK rose 3.6% to reach an all-time high of £272,003.0 in May.

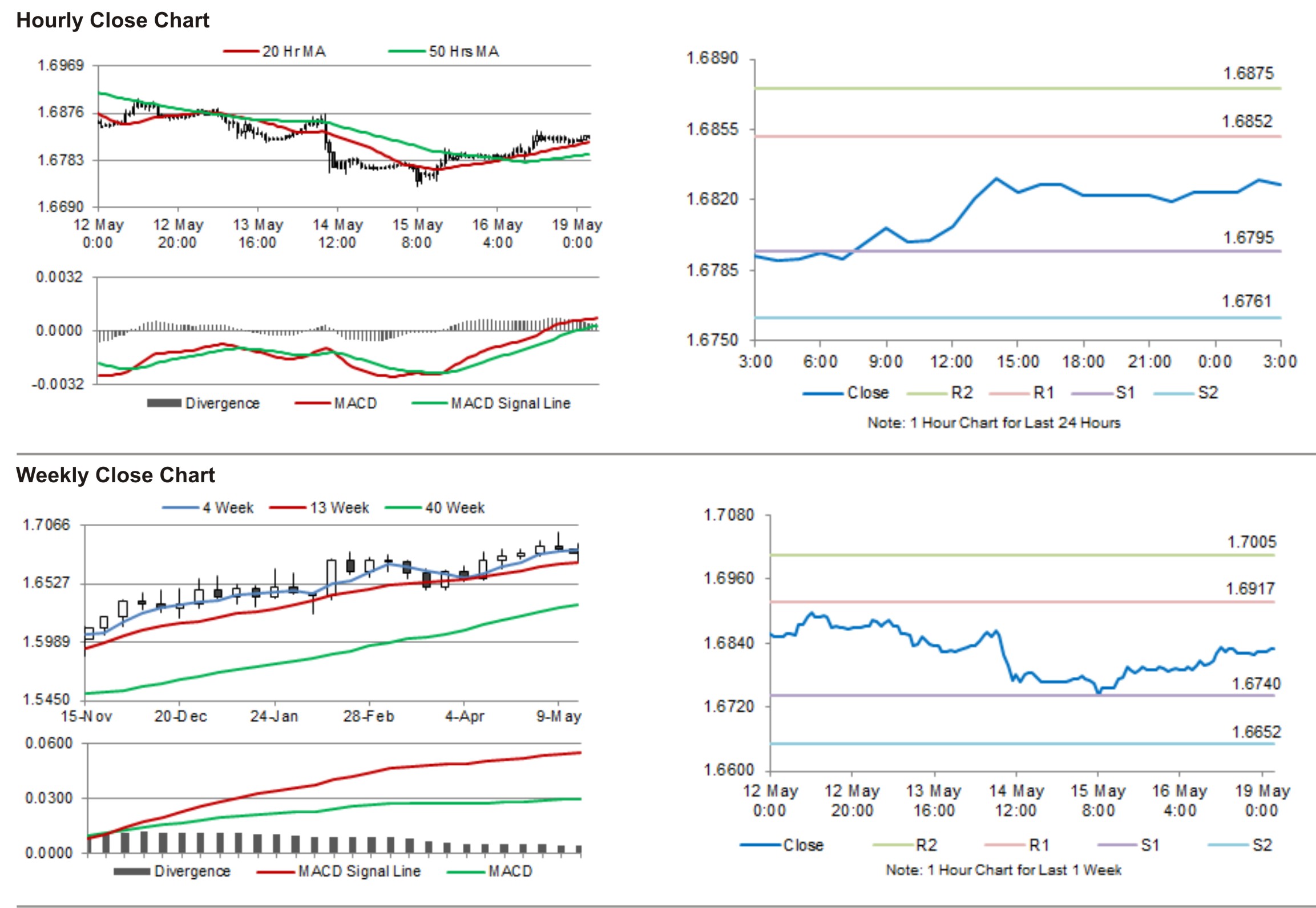

The pair is expected to find support at 1.6795, and a fall through could take it to the next support level of 1.6761. The pair is expected to find its first resistance at 1.6852, and a rise through could take it to the next resistance level of 1.6875.

Amid lack of major economic releases in the UK economy, later today, traders would eye UK’s consumer inflation data, due for release on Tuesday.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.