For the 24 hours to 23:00 GMT, the GBP declined 0.42% against the USD and closed at 1.3180.

Macroeconomic data showed that UK’s construction PMI declined to a level 49.5 in February, declining for the first time in 11 months and compared to a reading of 50.6 in the prior month. Market participants had anticipated the PMI to fall to a level of 50.5.

In the Asian session, at GMT0400, the pair is trading at 1.3154, with the GBP trading 0.20% lower against the USD from yesterday’s close.

Overnight data indicated that UK’s BRC retail sales across all sectors unexpectedly dropped 0.1% in February, defying market consensus for an advance of 0.1%. The BRC like-for-like sales had registered a rise of 1.8% in the prior month.

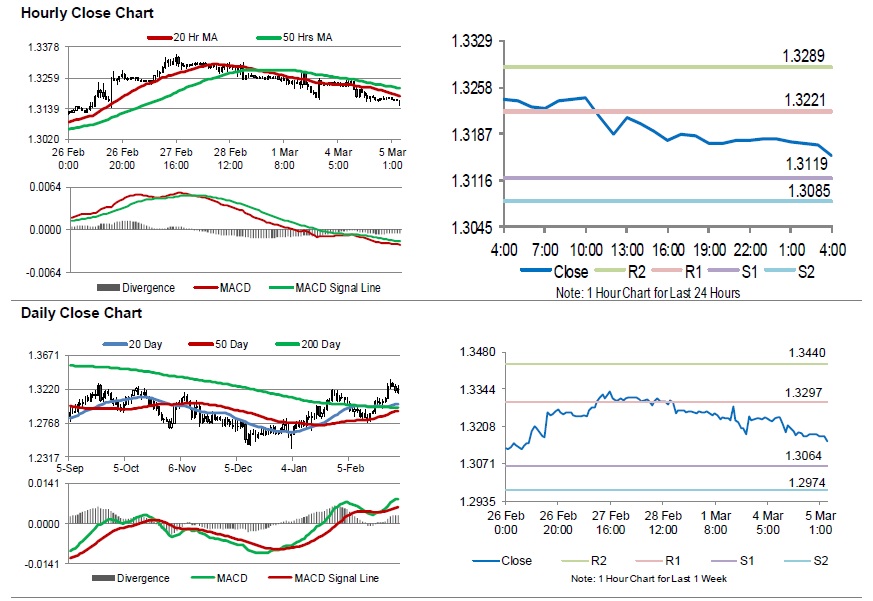

The pair is expected to find support at 1.3119, and a fall through could take it to the next support level of 1.3085. The pair is expected to find its first resistance at 1.3221, and a rise through could take it to the next resistance level of 1.3289.

Moving ahead, investors would keep an eye on UK’s Markit services PMI for February, set to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.