For the 24 hours to 23:00 GMT, the GBP declined 0.12% against the USD and closed at 1.2351, on growing concerns over Britain’s exit from the European Union (EU), after the UK’s Prime Minister Theresa May denied a Parliamentary vote on the final Brexit deal agreed with the EU.

In other economic news, UK’s public sector net borrowing posted a more-than-expected deficit of £12.2 billion in November, following a revised deficit of £4.3 billion in the previous month and against market expectation for the public sector net borrowing to show a deficit of £11.6 billion.

In the Asian session, at GMT0400, the pair is trading at 1.2366, with the GBP trading 0.12% higher against the USD from yesterday’s close.

Overnight data revealed that the nation’s consumer confidence index surprisingly improved to a level -7.0 in December, confounding market anticipation for the index to remain steady at -8.0.

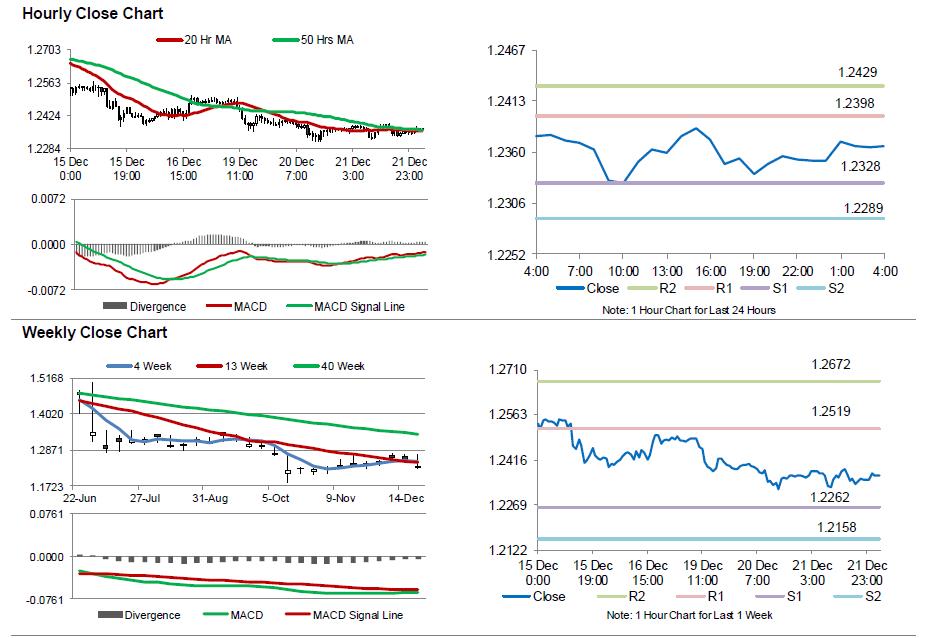

The pair is expected to find support at 1.2328, and a fall through could take it to the next support level of 1.2289. The pair is expected to find its first resistance at 1.2398, and a rise through could take it to the next resistance level of 1.2429.

With no economic releases in UK today, trading trend in the GBP is expected to be determined by global macroeconomic events.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.