For the 24 hours to 23:00 GMT, the GBP slightly declined against the USD and closed at 1.3790, after UK’s annual inflation eased from a nearly 6-year high level in December.

Data revealed that Britain’s consumer price index (CPI) climbed 3.0% on an annual basis in December, after recording a nearly 6-year high level of 3.1% in November, thus suggesting that the post-Brexit hit to the cost of living may finally be abating. Markets were anticipating the CPI to rise 3.0%.

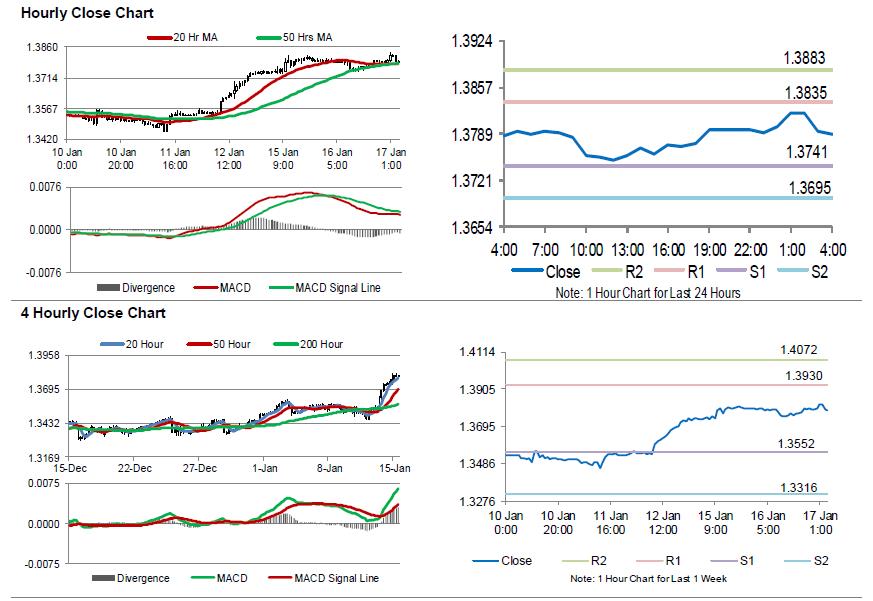

In the Asian session, at GMT0400, the pair is trading at 1.3788, with the GBP trading a tad lower against the USD from yesterday’s close.

The pair is expected to find support at 1.3741, and a fall through could take it to the next support level of 1.3695. The pair is expected to find its first resistance at 1.3835, and a rise through could take it to the next resistance level of 1.3883.

In absence of any macroeconomic releases in the UK today, investor sentiment would be governed by global macroeconomic factors.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.