For the 24 hours to 23:00 GMT, the GBP fell 1.08% against the USD and closed at 1.4217, after Britain’s inflation data missed market expectations.

Data showed that Britain’s consumer price index rose less-than-expected by 0.2% MoM in February, compared to market expectations for an advance of 0.4% and following a drop of 0.8% in the previous month. Additionally, annual growth in the nation’s inflation unexpectedly remained unchanged at 0.3% in February from January, thereby raising expectations that the BoE will maintain record-low interest rate for a long time.

Another set of data showed that the nation’s public sector net borrowing posted a deficit of £6.5 billion in February, as compared to a revised surplus of £14.4 billion in the previous month. Markets were anticipating it to show a deficit of £5.3 billion.

In the Asian session, at GMT0400, the pair is trading at 1.4206, with the GBP trading 0.08% lower from yesterday’s close.

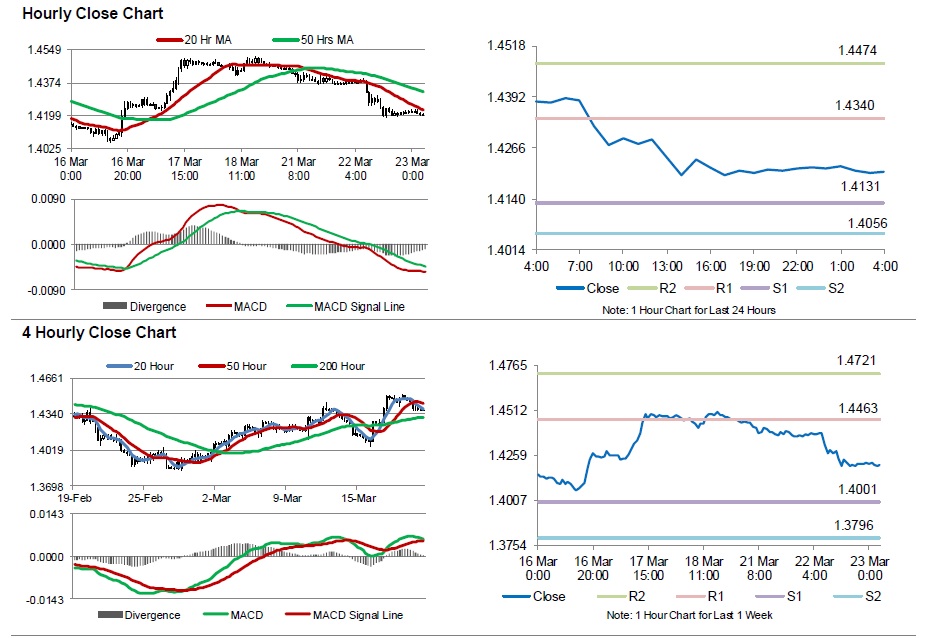

The pair is expected to find support at 1.4131, and a fall through could take it to the next support level of 1.4056. The pair is expected to find its first resistance at 1.4340, and a rise through could take it to the next resistance level of 1.4474.

With no economic releases in UK today, investors will look forward to the nation’s retail sales and BBA mortgage approvals data, both for the month of February, due tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.