For the 24 hours to 23:00 GMT, the GBP rose marginally against the USD and closed at 1.5216, after UK’s consumer price inflation rebounded in line with market expectations on a monthly basis in October.

Data showed that Britain’s consumer price index advanced 0.1% MoM in October, at par with investor expectations, after declining by 0.1% in the previous month. However, annual inflation rate remained negative in October, thus dampening the expectations of an interest rate hike any time soon.

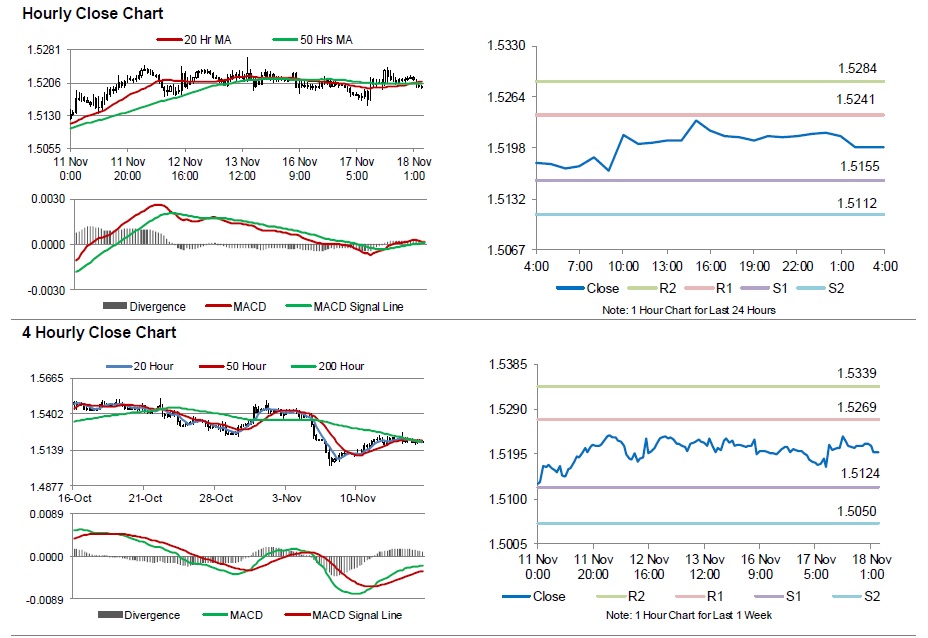

In the Asian session, at GMT0400, the pair is trading at 1.5199, with the GBP trading 0.11% lower from yesterday’s close.

The pair is expected to find support at 1.5155, and a fall through could take it to the next support level of 1.5112. The pair is expected to find its first resistance at 1.5241, and a rise through could take it to the next resistance level of 1.5284.

Moving ahead, investors will concentrate on UK’s retail sales data for October, scheduled to be released tomorrow.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.