For the 24 hours to 23:00 GMT, the GBP marginally declined against the USD and closed at 1.2802.

On the macro front, second estimate of gross domestic product (GDP) rose 0.3% on a quarterly basis in the second quarter of 2017, confirming the flash estimate. In the prior quarter, the nation’s GDP had advanced 0.2%. Additionally, the nation’s BBA mortgage approvals surged to a five-month high level of 41.59K in July. In the prior month, BBA mortgage approvals had recorded a revised reading of 40.39K.

On the other hand, the nation’s preliminary total business investment remained flat on a quarterly basis in the three months to June, meeting market expectations. In the prior quarter, total business investment had climbed 0.6%.

In the Asian session, at GMT0300, the pair is trading at 1.2809, with the GBP trading slightly higher against the USD from yesterday’s close.

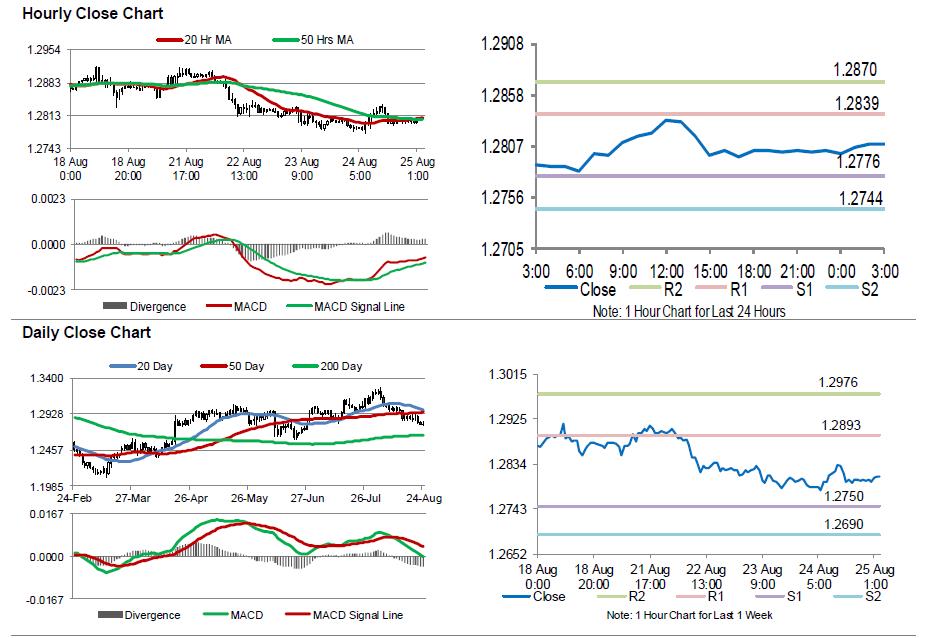

The pair is expected to find support at 1.2776, and a fall through could take it to the next support level of 1.2744. The pair is expected to find its first resistance at 1.2839, and a rise through could take it to the next resistance level of 1.2870.

Amid a lack of any macroeconomic releases in Britain today, investors will focus on UK’s Markit manufacturing PMI, consumer credit and GfK consumer confidence data, all due to release next week.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.