For the 24 hours to 23:00 GMT, the GBP declined 0.23% against the USD and closed at 1.3003, after UK’s leading think tanker, NIESR estimated that UK’s economy grew at a slower pace of 0.3% in the three months through July 2016, indicating that the nation lost momentum as the impact of Brexit vote led to a pronounced weakness in economic activity. The economy grew by 0.6% in the previous quarter while markets expected it to rise by 0.4%.

In other economic news, the nation’s industrial production rose by 0.1% on a monthly basis in June, at par with investor expectations and compared to a revised drop of 0.6% in the previous month. On the other hand, the nation’s manufacturing production contracted more-than-anticipated by 0.3% MoM in June, contracting for the second straight month. Markets expected for a drop of 0.2%, following a revised decline of 0.6% in the prior month. Further, the nation’s total trade deficit rose to a level £5.08 billion in June, expanding to the highest level since March 2015, compared to market expectations of a trade deficit of £2.55 billion and following a revised trade deficit of £4.23 billion in the previous month.

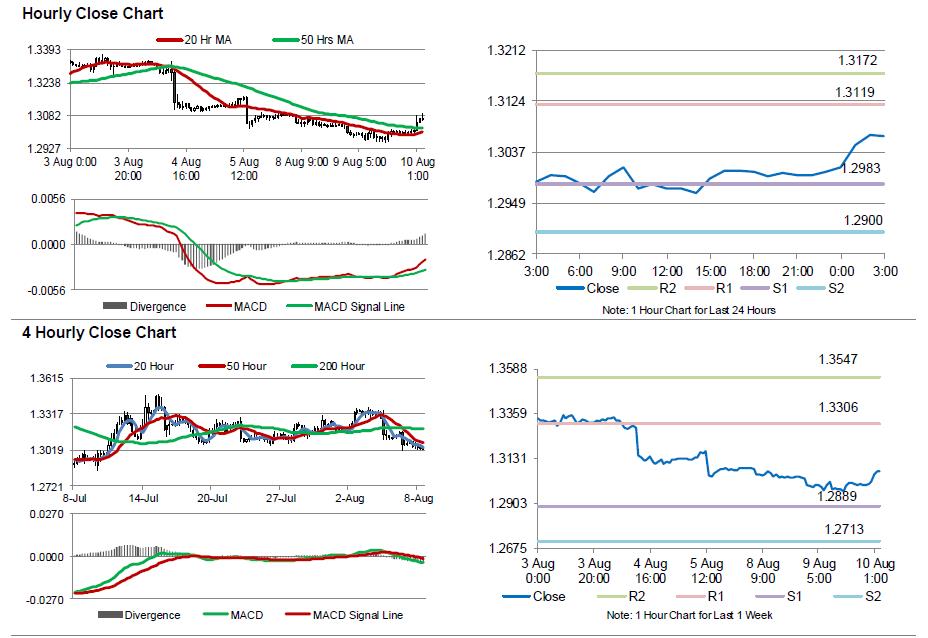

In the Asian session, at GMT0300, the pair is trading at 1.3065, with the GBP trading 0.48% higher from yesterday’s close.

The pair is expected to find support at 1.2983, and a fall through could take it to the next support level of 1.2900. The pair is expected to find its first resistance at 1.3119, and a rise through could take it to the next resistance level of 1.3172.

Moving forward, investors await the release of UK’s RICS house price balance data, scheduled tonight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.