For the 24 hours to 23:00 GMT, the GBP rose 0.48% against the USD and closed at 1.2854, after the Brexit Party disagreed to contest for seats previously held by Conservative in the last election.

On the data front, UK’s preliminary gross domestic product (GDP) advanced 0.3% on a quarterly basis in 3Q 2019, less than market consensus for a rise of 0.4%. In the prior quarter, the GDP had recorded a fall of 0.2%. Further, Britain’s goods trade deficit widened to £12.5 billion in September, compared to a revised deficit of £10.8 billion in the previous month. Moreover, the nation’s manufacturing production dropped more-than-expected by 1.8% on an annual basis in September, compared to a revised fall of 1.6% in the previous month. Likewise, the nation’s industrial production fell 1.4% on an annual basis in September, more than market expectations for a drop of 1.3%. In the prior month, industrial production had recorded a drop of 1.8%. On the contrary, the nation’s construction output rose 1.2% on a yearly basis in September, following a a revised rise of 1.1% in the prior month.

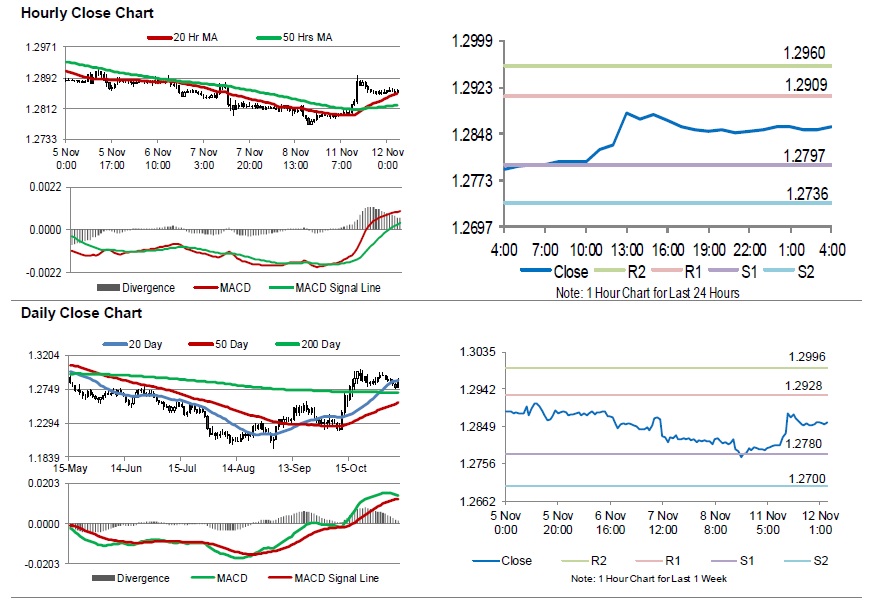

In the Asian session, at GMT0400, the pair is trading at 1.2859, with the GBP trading marginally higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2797, and a fall through could take it to the next support level of 1.2736. The pair is expected to find its first resistance at 1.2909, and a rise through could take it to the next resistance level of 1.2960.

Trading trend in the Sterling today, is expected to be determined by UK’s ILO unemployment rate and average earning, both for September, scheduled to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.