For the 24 hours to 23:00 GMT, the GBP rose 0.12% against the USD and closed at 1.2983.

Data indicated that UK’s business optimism climbed 16.0% in 4Q 2018, as compared to a decline of 3.0% in the prior quarter. Market participants had envisaged a fall of 4.0%.

On the other hand, CBI total trends orders unexpectedly eased at its fastest pace in three-years to a level of -6.0 in October, compared to market consensus for an advance to a level of 2.0. In the preceding month, the total trends orders had recorded a level of -1.0.

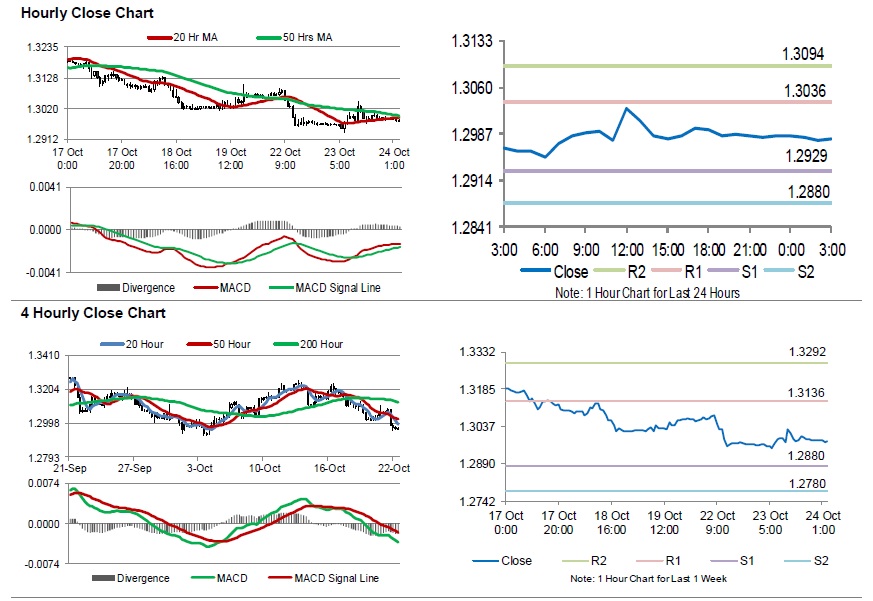

In the Asian session, at GMT0300, the pair is trading at 1.2979, with the GBP trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2929, and a fall through could take it to the next support level of 1.2880. The pair is expected to find its first resistance at 1.3036, and a rise through could take it to the next resistance level of 1.3094.

Trading trend in the Sterling today is expected to be determined by the release UK’s BBA mortgage applications for September, scheduled to release in a while.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.