For the 24 hours to 23:00 GMT, the GBP rose 1.23% against the USD and closed at 1.2761, amid renewed hopes over a divorce deal between Britain and the European Union.

On the macro front, UK’s ILO unemployment rate unexpectedly advanced to 3.9% in the three months ended August 2019, compared to market expectations for a steady reading. The ILO unemployment rate stood at 3.8% in the May-July 2019 period. Meanwhile, the nation’s average earnings including bonus climbed 3.8% in the June-August 2019 period, less than market anticipations for a rise of 3.9%. The average earnings including bonus had recorded a revised increase of 3.9% in the three months ended July 2019.

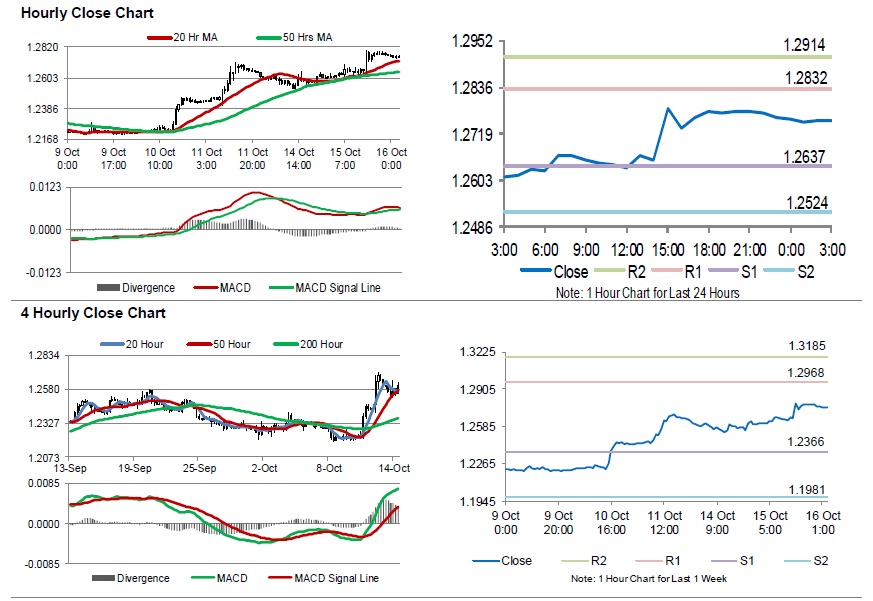

In the Asian session, at GMT0300, the pair is trading at 1.2751, with the GBP trading 0.08% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2637, and a fall through could take it to the next support level of 1.2524. The pair is expected to find its first resistance at 1.2832, and a rise through could take it to the next resistance level of 1.2914.

Going forward, traders would await UK’s consumer price index, producer price index and the retail price index, all for September, slated to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.