For the 24 hours to 23:00 GMT, the GBP rose 0.31% against the USD and closed at 1.3848 on Friday, boosted by upbeat industrial production figures in the UK.

Data revealed that Britain’s industrial production rebounded 1.3% on a monthly basis in January, rising by the most since December 2016, driven by the reopening of a key oil pipeline. However, the reading missed market expectations for an advance of 1.5%. In the prior month, industrial production had dropped 1.3%. Additionally, the nation’s manufacturing production rose less-than-anticipated by 0.1% on a monthly basis in January, after recording a gain of 0.3% in the previous month and compared to market expectations for an increase of 0.2%.

On the other hand, the nation’s construction output slid 3.4% on a monthly basis in January, dipping to its weakest since June 2012 and indicating that construction industry is undergoing a severe slump at the start of the year. Market participants had expected construction output to drop 0.5%, after recording a rise of 1.6% in the previous month. Further, the nation’s total trade deficit widened less-than-estimated to £3.07 billion in January, following a revised deficit of £2.49 billion in the previous month, while markets were expecting the nation to post a deficit of £3.40 billion.

In other economic news, leading think tank, NIESR estimated that UK’s gross domestic product (GDP) climbed 0.3% in the three months ended February, less than market consensus for an advance of 0.4%. In the November-January 2018 period, the NIESR had estimated that the nation’s economy grew by a revised 0.4%.

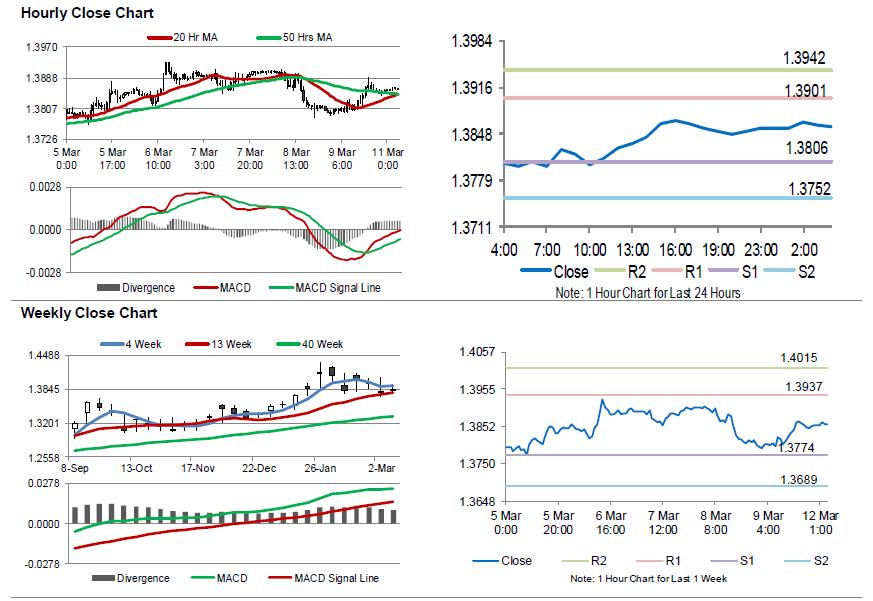

In the Asian session, at GMT0400, the pair is trading at 1.3859, with the GBP trading 0.08% higher against the USD from Friday’s close.

The pair is expected to find support at 1.3806, and a fall through could take it to the next support level of 1.3752. The pair is expected to find its first resistance at 1.3901, and a rise through could take it to the next resistance level of 1.3942.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.