For the 24 hours to 23:00 GMT, the GBP declined 0.20% against the USD and closed at 1.2695.

On the data front, UK’s consumer price index (CPI) advanced 2.5% on a yearly basis in July, rising for the first time in eight months and in line with market expectations. The CPI had climbed 2.4% in the prior month. Moreover, the nation’s the retail price index climbed 3.2% on annual basis in July, less than market expectations for a gain of 3.4%. In the previous month, the index had registered an advance of 3.4%. Additionally, the house price index rose 3.0% on an annual basis in June, higher than market consensus for a rise of 2.6%. In the preceding month, the index had recorded a revised rise of 3.5%.

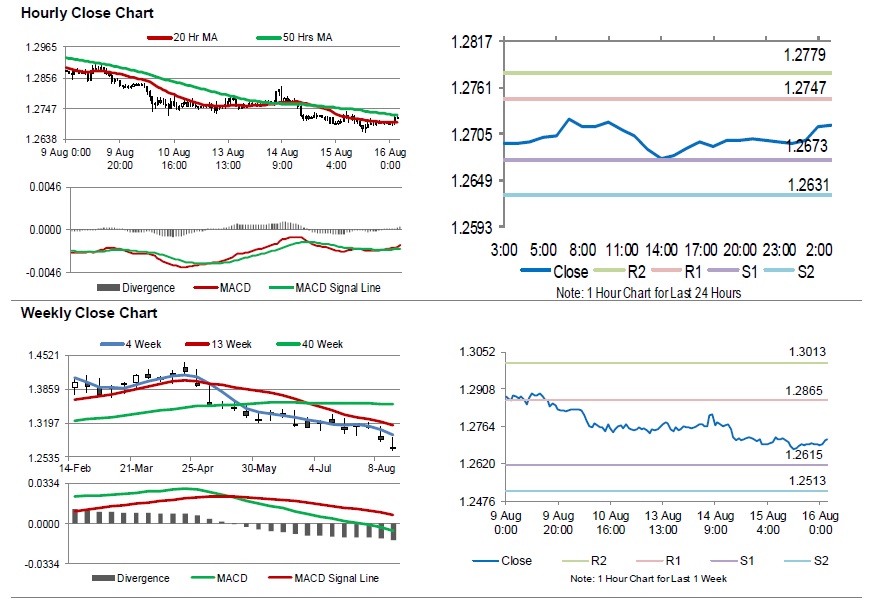

In the Asian session, at GMT0300, the pair is trading at 1.2716, with the GBP trading 0.17% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2673, and a fall through could take it to the next support level of 1.2631. The pair is expected to find its first resistance at 1.2747, and a rise through could take it to the next resistance level of 1.2779.

Trading trend in the Pound today is expected to be determined by UK’s retail sales data for July, slated to release in a few hours.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.